Evolving Liquidity Solutions: Factoring and Receivables Finance for U.S. Mid-Market Companies

For U.S. mid-market CFOs and treasury professionals, working capital optimization is no longer a mere technical exercise—it is a fundamental driver of competitiveness, resilience, and sustainable growth. In today’s rapidly evolving landscape, the accounts receivable financing market is expanding at breakneck speed, projected to grow from $147 billion in 2024 to over $250 billion by 2029, with a CAGR exceeding 11% (Research and Markets, 2024). This acceleration is fueled by mounting liquidity pressures, rising global trade complexity, and a new generation of digital platforms that enable real-time, data-driven finance strategies.

Factoring, once considered a tactical or even last-resort tool, now sits at the strategic core of group-level liquidity management for many U.S. mid-market firms. But while new AR financing instruments and technologies proliferate, true competitive advantage calls for more than just adding tools—it requires integration, transparency, and intelligent orchestration.

The critical questions facing finance leaders are: When does factoring deliver sustainable benefits? How can it be steered for total visibility, cost efficiency, and risk control?

The Meaning and Role of Factoring in Business Finance

Factoring as a Transformative—not Just Administrative—Tool

For US mid-market companies, factoring has evolved far beyond its origins as a last-resort cash fix or administrative workaround. Today, strategic use of factoring enables finance leaders to actively manage liquidity at the group level, optimize working capital deployment, and allocate funds precisely where they drive the most value—often across a complex landscape of entities, currencies, and evolving business units.

Factoring enables mid-market finance teams to unlock working capital, gain cash flow predictability, reduce DSO while keeping competitive customer terms, and diversify funding sources—all while adapting the structure (recourse, non-recourse, outsourced AR, multi-currency) to group complexity or international operations.

Crucially, expert finance teams view factoring not as a blanket solution but as a flexible, data-driven tool to supplement wider funding strategies and ensure optimal use of each dollar unlocked.

Recent Trends in Accounts Receivable Financing in the US Market

The US factoring and AR financing market is shifting rapidly, driven by both economic conditions and rising expectations from CFOs and PE sponsors. Key trends include:

- •

Adoption by larger, multi-entity groups: Factoring is no longer the preserve of smaller, single-entity firms. Multi-division groups with complex structures increasingly use multi-provider, multi-currency solutions to unify visibility and optimize cross-border cash flows.

- •

Expansion into export and trade finance: As US companies expand internationally, export-oriented and multi-jurisdictional factoring is growing—enabling better risk transfer and liquidity even on foreign receivables.

- •

Demand for full integration and transparency: Modern treasury teams now expect factoring management software to natively sync with AR ledgers, ERP, and cash flow forecasting systems. Transparency of costs, terms, and exposures group-wide—down to the entity and customer level—is now non-negotiable

- •

Sophistication in analytical tools: Leading platforms now go far beyond basic invoice or facility tracking—enabling scenario modeling (such as testing DSO or multi-currency impacts), consolidated dashboards for compliance, and granular analytics on cost, headroom, liquidity, and margin impact. This level of transparency is increasingly expected not only by boards and PE sponsors, but also by banks and other lenders.

When and Why to Choose Factoring Over Traditional Credit Lines

Factoring is particularly strategic for companies—across sectors like manufacturing, consumer goods, B2B services, or distribution—that regularly issue invoices on extended payment terms. It’s not restricted to SMEs; public and mid-market firms frequently leverage factoring to balance growth with day-to-day operating needs.

Factoring is especially strategic—or a strong alternative to traditional credit and traditional loans—in mid-market or multi-entity contexts when:

- •

Immediate working capital is required: Securing liquidity rapidly for market opportunities, large customer orders, production surges, or seasonal peaks—without waiting for accounts receivable to mature.

- •

Major investments or unforeseen expenses arise: Funding additional inventory, equipment, or operational costs directly from AR, allowing the business to respond quickly to planned growth or address unexpected needs.

- •

Customer terms must remain competitive: Preserving standard payment terms (net 60, net 90, etc.) to drive sales or sustain customer loyalty, while accelerating your own cash conversion.

- •

Delayed revenue realization or chronic late payment is a challenge: When revenues are hampered by sector traditions or client payment delays, factoring stabilizes cash flow and lessens pressure on other credit facilities.

- •

Receivables management is a challenge to scale: Streamlining and potentially outsourcing portions of AR or dunning to refocus finance teams on more value-added analysis—especially attractive for organizations struggling with high AR admin overhead.

- •

Risk management and customer quality are priorities: Leveraging the factor’s external credit expertise for customer vetting, and (with non-recourse contracts) transferring the risk of bad debt from the business to the factor.

CFO Perspective: While factoring unlocks much-needed cash flow agility, every scenario should be measured against its impact on gross-to-net margin, client relationships, and alignment with broader capital allocation strategies.

Accounts Receivable Financing: Understanding Factoring’s Full Scope

What Constitutes Accounts Receivable Financing?

Accounts receivable financing covers a continuum of solutions to unlock cash from outstanding invoices—without waiting for customers to pay. At its core, it comprises two principal models:

- •

Invoice factoring: Receivables are sold to a third-party (the “factor”), which advances a substantial portion of the invoice value upfront. The factor often assumes responsibility for collections and may absorb the risk of non-payment, depending on the contract structure (see recourse vs. non-recourse below).

- •

Invoice financing: Receivables serve as collateral for a line of credit or loan. The company keeps ownership—and remains responsible for collection and customer contact. Funds are drawn as needed, and repayment follows actual invoice settlement.

Other solutions within the AR financing arena include reverse factoring (where suppliers are paid early by a finance partner), selective factoring (targeting specific invoices or debtor segments), and multi-currency/export arrangements for internationally-oriented groups.

Factoring vs. Invoice Financing—Key Differences for Finance Leaders

While both approaches improve liquidity using outstanding receivables, their impact on risk, costs, and customer processes is distinct. Finance leaders must weigh these differences to select the best fit for their operating model.

| Invoice Factoring | Invoice Financing |

|---|---|---|

Cash Flow Access | Very fast (often 24–48h after invoice verification) | Draws available after set-up, on demand |

Collections | Handled by the factor (full-service or disclosed) | Handled internally by the business |

Risk Transfer | Recourse: Company bears default risk | Company retains full credit risk |

Cost Structure | Fees typically charged each period, may include admin & service charges; rates (total APR) can be significant if client payment cycles are long | Interest charged on drawn balances; lower if AR processes are robust |

Customer Impact | Customer often receives notice to pay the factor directly; This can affect customer experience or payment routines. (except with confidential factoring, where customers are not informed). | Customers unaware of financing, relationship and process unchanged |

Collateral & Qualification | Based on customer creditworthiness; usually little to no additional collateral, but factor may file blanket lien | Based on business and AR health; lenders may request additional collateral or guarantees |

Reporting & Accounting | Off-balance for sold receivables (if non-recourse), improves certain ratios (leverage, liquidity ratios, or working capital, depending on accounting standards) | Remain on-balance, affects leverage calculations |

Practical Impacts:

- •

Factoring can be easier and faster to obtain—particularly for companies with strong customer portfolios, variable financial performance, or more limited collateral. However, costs tend to be higher due to full-service administration, credit vetting, and risk coverage.

- •

Invoice financing, while potentially less costly and invisible to customers, places full responsibility for cash collection and recovery on the business. Its cost, transparency, and suitability depend on the company’s AR health and collection discipline.

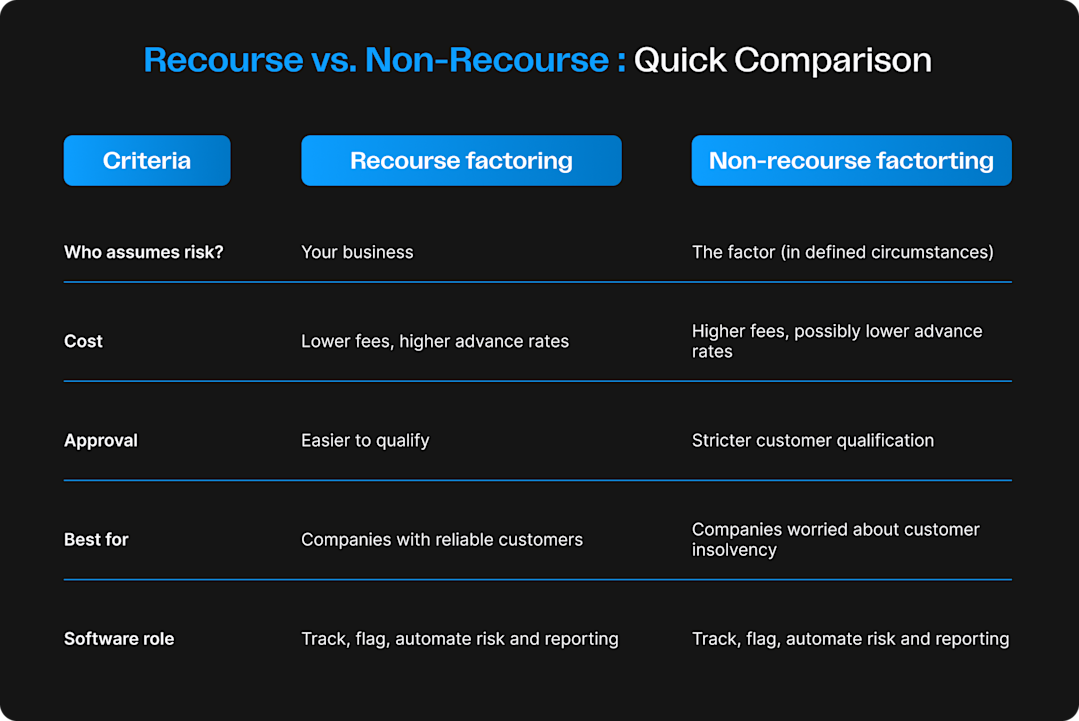

Focus: Recourse vs. Non-Recourse Factoring—An Essential Decision

A critical, yet sometimes misunderstood, aspect of invoice factoring is the distinction between recourse and non-recourse agreements. The choice has direct implications for risk allocation, pricing, and even how funding appears in your company’s financial statements.

- •

Recourse factoring: In this model, if a customer fails to pay, your business is ultimately responsible for reimbursing the factor. While fees are typically lower, the credit risk of each customer remains on your balance sheet. This option can make sense for organizations with deep knowledge of their customers’ solvency and robust internal credit controls.

- •

Non-recourse factoring: Here, the factor assumes certain default risks (most often in case of bankruptcy or insolvency of an approved customer). This comes at a higher cost and is subject to the factor’s eligibility criteria, but it transfers the most pressing risk out of your organization and can simplify reporting.

CFO insight: Choosing between recourse and non-recourse factoring isn’t simply a matter of cost. It influences your risk posture, margin profile, and even the level of executive and board oversight required. A rigorous evaluation should always factor in liquidity needs, sector risk, portfolio concentration, and your organization’s appetite for margin volatility.

Other Forms: Reverse, Selective & Export Factoring

Beyond classic invoice factoring and financing, the accounts receivable toolkit includes flexible and targeted options for treasury optimization:

- •

Reverse factoring (supply chain finance): Instead of accelerating payment on your invoices, this mechanism enables your suppliers to get paid early—often at better rates—while you maintain or even extend your own payment terms. It's a powerful way to stabilize your supply chain and improve supplier relationships.

- •

Selective factoring: This approach allows finance teams to choose which invoices or customer segments to factor. You might focus on high-ticket, slow-paying, or higher-risk debtors, balancing funding needs and cost efficiency.

- •

Export or multi-currency factoring: For mid-market or PE-backed groups with international operations, these solutions provide vital liquidity support for export sales, while managing FX risk and cross-border exposure.

Expert perspective: A mature AR financing strategy blends these tools to serve both operational and strategic priorities—building in flexibility, cost control, and risk mitigation in a tailored, data-driven way.

Factoring in the Treasury Toolbox: Advantages, Drawbacks, and Strategic Alternatives

Why CFOs Use Factoring

- •

Accelerate cash flow: Convert sales into immediate liquidity; cover peaks in demand or bridge working capital gaps.

- •

Preserve sales terms: Offer competitive or extended payment terms to customers, without straining internal cash.

- •

Streamline AR: Outsource invoice processing and, in some contracts, collections—reducing administrative burden for the finance team.

- •

Fit for B2B: Especially suited for companies selling to other businesses on payment terms.

- •

Monetize strong but slow-paying customers: Turn receivables from creditworthy clients into cash, even when payment periods are long or industry-standard delays occur.

- •

Apply where margins allow: Use factoring selectively for higher-margin products, segments, or customers—avoiding net profit erosion.

While factoring can be used as an ongoing working capital lever, it can also be treated as a special case solution for specific situations such as a major acquisition, a temporary cash crunch, or a one‑off growth spike that cannot be covered by existing credit facilities.

Watch-Outs & Limitations

- •

Margin dilution: Factoring fees (1–5%+ per cycle) and administrative charges are direct hits to net margin—scrutinize cumulative costs and fee structures.

- •

Customer dependency: Costs and access depend on your customers’ payment reliability; high late payment rates can drive up your actual cost or limit your eligibility.

- •

Relationship risk: You may lose some control over the customer experience—direct factor-customer contact can confuse or distance key accounts.

- •

Risk remains in recourse deals: If a factored invoice goes unpaid, your company ultimately records the loss. Any non-recoverable amount must be recognized as a bad debt expense on your P&L, directly impacting net profit.

- •

Complexity in multi-entity/groups: Integration gaps with AR, ERP, or cash forecasting can dilute control or introduce reconciliation errors—technology alignment is essential.

Expert tip: Integrate factoring into your working capital mix, not as a default solution. Model the total cost and margin impact for each segment. Set clear ownership of customer communications and collections internally versus the factor. Regularly benchmark versus alternative funding to make sure the benefit justifies the cost.

Comparing Factoring With Other Working Capital Levers

Before adopting or ramping up factoring, CFOs and treasurers need to compare it side by side with other funding tools available to mid-market organizations. Each solution comes with distinct advantages, limitations, and suitability depending on your liquidity needs, cost structure, customer profile, and operational complexity, as well as the terms offered by your existing lenders.

The following table summarizes how factoring stacks up against key working capital levers along the most critical decision criteria.

Solution | Cost | Margin Impact | Customer Impact | Scalability | Use Case |

|---|---|---|---|---|---|

Factoring | Medium | Direct hit: fees and interest directly reduce net margin | Moderate–High | High | High DSO, cash crunch, growth spurts |

Invoice Financing | Medium | Moderate, but may be more predictable and easier to allocate | Low | High | Buffering, less visible for customers |

Revolving Credit | Low | Lower, interest-only on drawn amounts | Low | Med-High | Ongoing ops, more predictable financing |

Supply Chain Finance | Low / Med | Indirect, spreads cost between buyer / supplier | Indirect | High | Support suppliers, leverage terms |

Dynamic Discounting | Low | Minimal / positive (often negotiable with suppliers) | Low | Case-by-case | Early pay discounts |

Integrating Factoring Strategically: Best Practices & Governance

To maximize the value and contain the risks of factoring, CFOs and treasury leaders need to move beyond tactical use and embed it within a disciplined governance framework. Below are proven best practices to ensure your factoring program delivers strategic benefit, operational efficiency, and robust financial control—especially in complex, multi-entity environments:

- •

Centralize real-time visibility: Use a unified dashboard for all factoring lines/providers, accessible by all relevant internal stakeholders.

- •

Sync with AR and cash flow tools: Automate the flow of data between your factoring arrangements, AR ledgers, and cash forecasts to ensure that your liquidity planning is always accurate.

- •

Benchmark and optimize: Track all costs and terms at entity and provider level. Routinely benchmark versus alternative tools (revolving, supply chain finance, invoice financing) to maximize yield and margin.

- •

Surface and manage risks: Flag concentration, provider exposure, and multi-currency issues proactively.

- •

Continuous improvement: Periodically review and renegotiate provider terms and the funding mix as your business and risk profile evolve.

- •

Apply selectively: Use factoring for the customers, invoices, or business units that deliver the strongest ROI, rather than as a blanket approach.

- •

Blend solutions: Integrate factoring with other working capital tools (such as dynamic discounting or supply chain finance) for maximum flexibility and impact.

When these practices are operated within a dedicated treasury platform like Agicap, finance teams achieve not only operational efficiency, but also confidence that factoring supports group strategy—instead of driving unintended cost or compliance risk.

Beyond the Basics: Factoring Trends and What’s Next for US Finance Teams

Factoring is evolving rapidly—both in how widely it’s used and in the sophistication of supporting technologies. Here are the trends every mid-market finance leader should track, not just as future predictions, but to anticipate rising market standards and capture new opportunities.

Integrated Data & Real-Time Visibility

With open banking and APIs, it’s now possible to hook AR, factoring, ERP, and cash forecasting solutions together for up-to-the-minute liquidity views, faster settlements, and fully automated reconciliation. Platforms like Agicap already enable these flows to deliver actionable insights on exposures, costs, and working capital needs.

Compliance and Secure Audit Trails

The centralized consolidation of financial data and detailed transaction histories streamline compliance and reporting for factoring activities. Finance teams can efficiently prepare for audits, ensure the traceability of transactions, and easily extract the necessary data for regulatory disclosures. Core KYC and anti-fraud verifications remain managed by financial partners.

Next-Gen Automation and Predictive Analytics

AI-driven eligibility, automated risk assessments, and predictive cash flow outputs are already emerging in best-in-class solutions. While these technologies are still ramping up, their promise is simple: to help finance teams make smarter, real-time decisions about when (or when not) to factor, and at what cost.

Expert tip: Choose a platform that is evolving rapidly with the market; a solution that stagnates risks locking you out of tomorrow’s liquidity and compliance standards.

How Agicap Supports Accounts Receivable Financing and Factoring

As mid-market organizations demand increased visibility and control, Agicap offers a unified treasury platform that enables comprehensive monitoring and reporting of factoring-related cash flows as well as overall liquidity positions.

- •

Seamless Integration between AR and Cash Forecasting: Agicap’s real-time link between accounts receivable and cash forecasting means that factored or financed invoices, settlements, and disputes are instantly reflected in cash positions and forecasts. This integration prevents double-counting and ensures funding decisions are based on the most accurate, current data.

- •

Centralized Visibility: Dashboards allow finance teams to categorize and monitor factoring inflows and outflows, balances, and related cash impacts across all group entities and providers.

- •

ERP and Bank Integrations: Automated imports and reconciliation with supported ERPs and banking systems provide up-to-date views and accurate cash positioning.

- •

Dunning Management Adapted to Financing Context: Collection workflows can be adapted based on financing type. For fully sold invoices (non-recourse factoring), internal reminders can be suspended to avoid confusion and duplicate customer communication. For other financing types where your company retains collection responsibility, standard dunning continues to promote prompt payment.

- •

Multi-Entity & Multi-Currency Management: Consolidated reporting and cash visibility across subsidiaries, currencies, and providers, supporting both domestic and international operations.

Case in point: With Agicap, Maison Mirabeau anticipated its cash needs and strategically selected which invoices to finance—cutting factoring costs by 50%.

Ready to see how Agicap can transform your account financing management and factoring? Book a demo with our team today.

Conclusion – Factoring as a Core Finance Strategy

Factoring remains a high-impact, flexible lever within the US mid-market finance playbook—but long-term value requires more than deploying a new tool. True ROI comes from strategic integration, comprehensive real-time oversight, and agility in blending multiple working capital solutions as conditions change. Platforms like Agicap enable finance leaders to move confidently from tactical use of factoring to a data-driven, strategic approach—aligning liquidity management with the group’s growth and control objectives.

FAQ – Advanced Factoring Questions in US Mid-Market Finance

Can factoring be safely combined with other types of working capital finance?

Yes—best-in-class treasuries blend factoring, credit lines, and supply chain finance to fit group entity needs, growth stage, and market cycles.

What is a factoring company and what services does it provide to businesses?

A factoring company is a finance provider that purchases a business’s accounts receivable at a discount, advancing cash quickly against outstanding invoices. Its factoring services typically include funding (cash advances), credit checks on debtors, invoice administration, and sometimes collections. This helps businesses smooth cash flow, reduce DSO, and outsource part of their receivables management.

What is accounts receivable factoring and how does it work in finance?

Accounts receivable factoring (or factoring receivables) is a form of finance where a company sells its invoices to a factor in exchange for an immediate cash advance, usually 70–90% of the invoice value. The factor then collects payment from the customer and remits the balance minus fees. In finance, this is used to accelerate cash flow and reduce reliance on traditional credit lines.

How does debt factoring differ from traditional bank factoring or credit lines?

Debt factoring generally refers to selling receivables to a factor for immediate cash, with fees linked to invoice value and payment timing. Traditional bank factoring is similar but offered directly by a bank, often with stricter eligibility and documentation. Credit lines, by contrast, are loans or revolving facilities: you borrow against limits, keep the receivables, and remain fully responsible for collections and bad debts.

How is factoring treated in accounting and on the balance sheet?

Factoring in accounting depends on whether the arrangement is recourse or non‑recourse and on applicable standards. In true non‑recourse deals where risk is transferred, sold receivables may be removed from the balance sheet; in recourse factoring, they often remain as assets with a corresponding liability. In all cases, factoring fees are recorded as finance costs, impacting net profit.

What is included in a typical factoring agreement?

A factoring agreement sets out the commercial and legal terms of the relationship between the business and the factor. It defines advance rates, fees and interest, recourse vs non‑recourse conditions, eligible debtors and invoices, notification rules, dispute handling, covenants, and termination clauses. Understanding these terms is critical to assessing the real cost and flexibility of your factoring program.

How does factoring invoices and payments impact customer relationships?

When you use factoring invoices, customers may be notified to pay the factoring company directly, which can change their usual payment process. In disclosed factoring, this can create questions or confusion if not well communicated; in confidential arrangements, customers see no change. Well‑managed factoring payments should preserve service quality and trust, with clear roles between your team and the factor.