Dunning Software: Definition, 2026 Comparison & Best-in-class Solutions for US Finance Teams

For mid-market US finance leaders, optimizing accounts receivable has become a strategic necessity. The global accounts receivable automation market is expected to grow at a CAGR of nearly 13%—from $3.8 billion in 2023 to $8.8 billion by 2030—driven by the ongoing complexity of financial transactions and the increasing need for automation across all company sizes (Grand View Research, 2024). As transaction volumes grow and the number of entities increases, manual collections and ad hoc payment recovery efforts are no longer sustainable — delayed payments and lack of visibility directly impact working capital. Dunning software delivers automation, real-time analytics, and audit-ready controls, helping CFOs and AR managers accelerate cash collection, ensure compliance, and provide reliable group-level reporting.

This guide highlights advanced criteria for solution selection and benchmarks the top dunning platforms on the US market for mid-sized organizations.

What Is Dunning Software (or a Dunning System)? Definition & Key Selection Criteria

Definition & Core Scope

A dunning software, also called dunning system is a robust platform tailored to the needs of mid-market finance teams, enabling automated and scalable AR collections, centralized controls, and consolidated visibility across entities—essential for optimized cash and working capital management. Beyond routine reminders, it empowers CFOs and AR managers to accelerate cash inflows, enforce group-wide credit policies, streamline audit and compliance, and deliver real-time reporting on working capital.

Core scope of supplier dunning software

- •

Automated payment reminders (multi-channel): Deliver systematic, personalized dunning emails, letters, phone calls, or SMS based on predefined or custom schedules.

- •

Customer payment portal: Offer a secure platform where customers can review and pay open invoices instantly.

- •

Dispute and escalation management: Enable pausing or adapting dunning workflows for disputed invoices, with documentation and automated escalation paths for exception handling.

- •

AR analytics: Provide comprehensive AR aging analysis, DSO tracking, debtor segmentation, and dashboards for real-time, actionable insights at both entity and group level.

How Dunning Process Software Works: Main Features & Workflow Automation & Key Features

Modern dunning process software is typically cloud-based and designed to fully automate the collections process, from first reminder to final recovery or hand-off to legal action.

Key features include:

- •

Automated, multi-step collection workflows: Schedule tailored messaging and escalation by invoice age, customer segment, legal entity or credit risk—supporting both centralized/shared service and local AR teams.

- •

Integrated payment and dispute management: Direct links to self-service payment, configurable rules for dispute pauses, full audit trail of all actions and communications.

- •

Advanced analytics and AR dashboard: Group-level AR aging report, DSO by entity or portfolio, root cause tracking for disputes/non-payment, export-ready audit trails.

- •

Full integration with finance stack: Deep API or connector integration with leading ERPs, accounting, and bank systems for continuous data sync and automated payment reconciliation.

By centralizing and automating these processes, dunning software allows finance teams to shift focus from repetitive admin tasks towards strategic analysis, exception management, and optimizing stakeholder relationships.

Key Business Benefits of Dunning software

The impact of automated dunning on DSO and liquidity is not just theoretical. According to Agicap’s recent white paper “How to Reduce DSO and improve your cash conversion cycle”, mid-market companies that implement systematic and automated customer reminder processes can reduce average days delinquent by up to two weeks and triple the likelihood of collecting late invoices within 60 days of due date. These improvements directly translate into stronger cash conversion cycles, lower financing costs, and improved financial agility. They also provide more reliable inputs for financial planning, enabling finance leaders to align collection strategies with funding needs and growth objectives. By improving collection discipline and visibility, modern dunning software reduces the volume of invoices drifting into bad debt, directly protecting margins and working capital.

A well-implemented dunning solution drives measurable business impact for mid-market finance teams:

- •

Productivity & scalability: Automate and standardize AR collections across multiple entities, freeing teams for exception handling and strategic cash management.

- •

Accelerated cash flow & WCR optimization: Reduce DSO and support group liquidity.

- •

Audit and compliance transparency: Centralize supporting documentation, streamline SOX and internal audit processes, and accelerate period closes.

- •

Customer experience & retention: Enable consistent, brand-aligned, and segmented communication, protecting key client relationships and proactively minimizing churn.

- •

Strategic AR oversight: Consolidated, actionable insights at group, entity, business unit, or customer level for precise credit risk management, cash forecasting, and resource allocation.

- •

Risk mitigation & credit policy enforcement: Automated escalations and real-time debtor scoring help anticipate bad debt and optimize provisioning.

- •

IT & integration agility: Seamlessly connects to multiple ERPs or financial systems, reducing complexity and ensuring reliability of AR data.

What is the best dunning management software? 2026 expert comparison

Selecting the best dunning management software is a strategic decision for mid-market finance teams, as the solution must not only automate collections but also support multi-entity complexity, leverage advanced analytics, and integrate seamlessly with existing ERP environments. The following table provides a side-by-side comparison of leading dunning platforms in the US market, highlighting their core features, main advantages, and the company types or use cases to which they are best suited. This overview is designed to help finance leaders quickly identify which solution best aligns with their operational priorities, integration landscape, and group-level cash management needs.

Software | Features | Main Advantages | Target Fit |

|---|---|---|---|

Agicap | - ERP connectivity, real-time cash sync | - Unified AR and cash management in one platform | Mid-market companies (multi-site / multi-entity) needing consolidated AR/cash automation & visibility |

Upflow | - Multi-channel reminders | - Simple user experience | Mid-sized companies seeking focused AR automation |

YayPay (Quadient) | - Automated workflows | - Advanced analytics and forecasting | Data-driven mid-market and upper-mid-market companies; complex AR reporting needs |

Chaser | - Email reminders | - Fast deployment | SMEs and small mid-market companies seeking quick/flexible setup |

Esker Collections Mgmt | - Automated dunning | - Deep process automation | Large mid-market and enterprise organizations with complex AR needs |

HighRadius Collections Cloud | - AI-based dunning | - Scalability | Large mid-market and enterprise groups (complex, high-volume AR) |

CollBox | - Reminder automation | - Rapid implementation | SMBs and small businesses needing easy AR recovery solutions |

Lockstep (Sage) | - Automated reminders | - Collaborative AR features | Mid-market and larger Sage-based companies, collaborative AR teams |

Billtrust Collections | - Automated dunning | - Suited for credit-driven, high-scale AR | Large mid-market and enterprise credit departments |

Gaviti | - Multi-step dunning | - Customizable workflows | Mid-sized and growing companies needing tailored AR processes |

US Dunning Software Solutions: Detailed Overview

Agicap

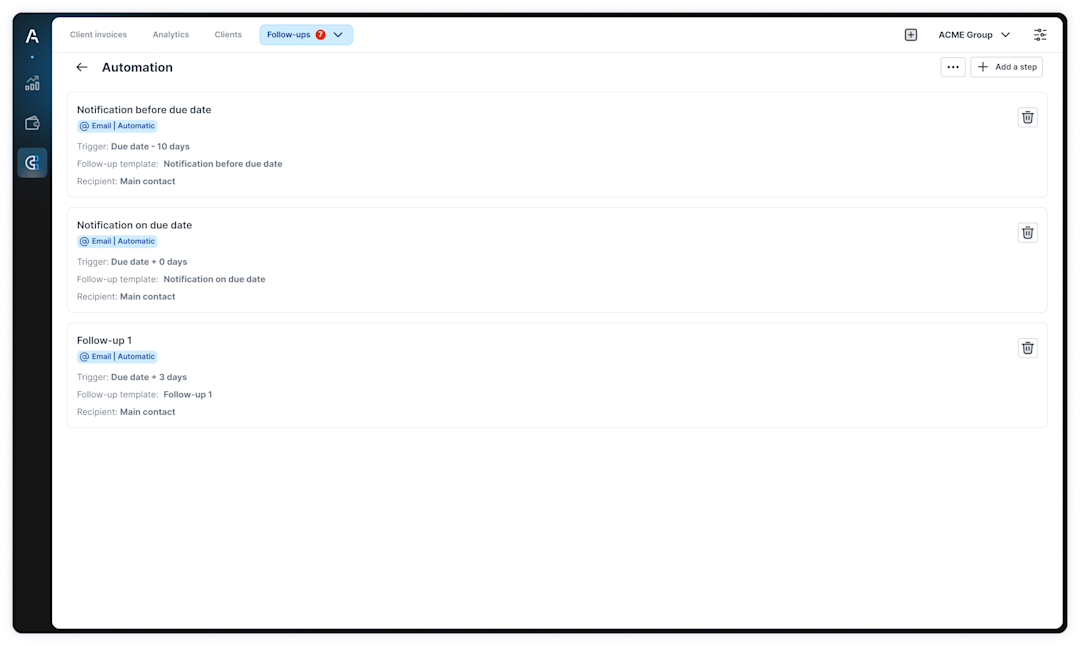

Agicap is an integrated AR automation and cash management platform designed for mid-market companies requiring consolidated control across multiple entities. The solution supports the full spectrum of the dunning process while offering real-time cash visibility, AI-powered payment date predictions, and advanced integration capabilities.

Key features include:

- •

Automated payment reminders by email and certified mail, with customizable sequences and templates

- •

Dispute management to pause or adapt workflows for invoices under dispute

- •

Ageing balance analysis and DSO analytics to monitor outstanding receivables and track collection performance

- •

Customer balance summaries for identifying top debtors and segmenting accounts receivable for targeted collection actions

- •

Overdue items dashboard for real-time monitoring and filtering of unpaid or overdue invoices

- •

Seamless integration with ERP/accounting systems and e-invoicing platforms

- •

Real-time synchronization with cash forecasting and liquidity planning in Agicap’s unified finance platform

- •

AI-based invoice-to-payment matching and predictive payment date estimation, enabling more accurate cash forecasting and reduced manual workload

- •

Automatic bank journal generation and export to ERP or accounting solutions to streamline accounting tasks

Upflow

Upflow specializes in automating AR follow-up through multi-channel reminders, dynamic AR dashboards, and a customer payment portal. The platform emphasizes intuitive workflow configuration and offers strong integration capabilities with leading ERP systems. Upflow is well-suited for organizations focused on AR process automation, while advanced cash management or treasury functionality usually requires complementary tools.

YayPay (Quadient)

YayPay focuses on collections workflow automation, advanced AR analytics, and risk scoring. It integrates with a broad array of ERP and payment providers, supporting sophisticated reporting and forecasting capabilities. YayPay is positioned for data-driven finance and AR teams managing higher transaction volumes or seeking detailed portfolio analytics. Some organizations may experience a moderate learning curve due to the platform’s breadth of features.

Chaser

Chaser specializes in customizable reminder workflows delivered primarily by email, with a customer payment portal and real-time AR aging for account tracking. The platform enables finance teams to set up tailored dunning sequences and escalation routes based on customer type or collection stage.

Quick to implement and easy to use, Chaser is particularly well-suited to SMEs and smaller mid-market organizations seeking a flexible, straightforward approach to digital collections. The solution’s focus is on core dunning; advanced dispute management or analytics are more limited compared to broader AR suites.

Esker Collections Management

Esker delivers a feature-rich AR and collections suite with automated dunning, in-depth dispute resolution workflows, and credit risk management. The platform provides extensive AR dashboards and supports process automation for high transaction volumes or complex customer portfolios. Esker integrates with mainstream ERP, CRM, and accounting solutions to centralize data and workflows.

It is particularly relevant for larger mid-market and enterprise organizations dealing with scale, compliance strictness, or multi-country AR complexity. Initial implementation is typically thorough, reflecting its depth of configuration and integration.

HighRadius Collections Cloud

HighRadius leverages artificial intelligence in optimizing collections workflows, predicting payment behaviors, and providing advanced reporting and dashboards for finance analysts. It supports robust automation of reminder sequences, portfolio segmentation, and risk exposure analysis. Integration is available for leading enterprise ERP and accounting platforms, enabling high-volume data flows and centralized AR management.

HighRadius is built for scale, meeting the needs of large mid-market and enterprise organizations with complex AR, though its wide-ranging features often require tailored configuration and change management.

CollBox

CollBox offers automated reminder sequences and direct integration with third-party collection agencies for escalated accounts. The platform is cloud-based and connects natively to widely-used SMB accounting solutions like QuickBooks and Xero. CollBox guides users in identifying overdue receivables and transferring cases to external collectors when needed.

The solution is intended for small and mid-sized businesses seeking a fast, low-complexity way to address AR recovery, with limited need for advanced workflow customization or analytics.

Lockstep (Sage)

Lockstep, now part of the Sage ecosystem, automates payment reminders, manages a collaborative AR email inbox for finance teams, and applies machine learning to match payments to invoices. The system provides visibility into collection activity and streamlines communication within AR teams. Tight integration with Sage accounting software is a highlight; for organizations using other ERP platforms, connectivity options may be more limited. Lockstep is suitable for mid-market and larger organizations leveraging Sage, especially those seeking more collaborative, team-based AR processes.

Billtrust Collections

Billtrust Collections combines automated dunning, a customer-facing payment portal, and robust AR analytics into one platform. It is engineered for high-volume, credit-driven environments and supports compliance, audit trail creation, and reporting across business units or regions. Billtrust integrates deeply with accounting and ERP systems and can handle significant scalability requirements. While the solution fits large mid-market and enterprise organizations, initial implementation may require project management and process alignment.

Gaviti

Gaviti is centered around automated, customizable multi-step dunning workflows, a workflow builder, and built-in AR reporting. The solution supports integrations with major ERP, payment, and accounting systems, helping finance teams design and adjust their own follow-up processes according to business needs. Gaviti is aimed at mid-sized and growing organizations that prioritize flexibility and control in AR automation. Its main focus is on collections workflow optimization; cash application and reconciliation features are less developed relative to dedicated cash management tools.

How Does Agicap Stand Out as a Dunning Software Alternative to Traditional Dunning Software?

Beyond Reminder Automation: Integration with Group Treasury Management

While most dunning software in the market provides robust payment reminder scheduling and escalation management—and some include specific reporting (DSO, outstanding balance, etc.) —these solutions often remain siloed within AR management. They typically do not support group-level treasury processes or integration with wider cash flow planning.

Agicap differentiates itself by delivering a unified platform that goes far beyond traditional dunning tools, connecting AR automation directly with cash management, liquidity planning, and full treasury workflows. This all-in-one approach is particularly well-suited for mid-market companies managing multiple entities and requiring group-level financial oversight.

Key Differentiators of Agicap:

- •

Unified cash and collections platform: Agicap brings together AR monitoring, automated dunning, dispute management, and end-to-end cash flow forecasting in a single environment, offering a centralized financial dashboard for finance leaders.

- •

Real-time AR to treasury synchronization: Every dunning action—whether a reminder is sent, a payment is recorded, or an invoice is disputed—feeds instantly into liquidity forecasts and group cash reporting. This eliminates batch syncing, manual spreadsheet work, and the risk of outdated projections.

- •

ERP and bank integrations: Automated data synchronization allows up-to-date AR, cash, and payment status across all systems.

- •

Customizable controls and workflows: Approval pathways for dunning and dispute resolution can be tailored to match internal governance and risk management requirements, enhancing compliance and audit-readiness.

- •

AI-driven cash application: Receipts are matched with open invoices using AI, automating reconciliation and providing finance teams with up-to-date, actionable data for both AR and treasury management.

- •

Holistic financial reporting: The platform aggregates AR, AP, and broader treasury data for consolidated reporting—across business units, entities, and the group level—equipping decision makers with transparent metrics for steering working capital, covenants, and liquidity.

- •

Business-led deployments: Agicap is designed for rapid implementation with minimal IT disruption, enabling mid-market finance teams to modernize their AR and treasury landscape quickly.

Case Study: Nutrisens

Nutrisens is an international nutrition group with $130M in sales and 10,000+ clients, operating in 20 countries. Rapid growth (+27% turnover) and a lean finance structure created challenges in scaling AR management and maintaining cash visibility.

Key challenges:

- •

Incomplete customer contact data hindering efficient collections

- •

Delayed or inconsistent reminders due to limited staff bandwidth

- •

Lack of real-time visibility on receivables and group liquidity

- •

Manual, time-consuming AR tracking

Solution with Agicap:

- •

Automated, multi-channel reminders ensured comprehensive outreach and timely payment follow-ups

- •

Centralized, constantly updated contact database enabled precise targeting and fewer missed accounts

- •

Real-time dashboard consolidated AR status, overdue exposures, and cash forecasts group-wide

Results:

- •

DSO reduced by 14% despite 27% growth in sales

- •

Overdue AR down 18%; invoices >30 days late down 39%; >90 days late down 36%

- •

Sharper working capital management and proactive cash planning

- •

Administrative workload shifted from manual dunning to high-value analysis

“At Nutrisens, we needed to manage a significant amount of data and credits. Additionally, we had a very high DSO and aimed to reduce it, but with a rather small administrative structure. Therefore, we needed to automate and review our processes. At the same time, another fundamental aspect for us was treasury management, with the need to have immediate and quick visibility of the cash situation and to make reliable forecasts both in the short and long term. All of this led us to rely on Agicap, with which we achieved very satisfactory results in a very short time.” — Roberto de Bonis, CFO, Nutrisens

Conclusion & Key Insights

For US mid-market finance leaders, optimizing accounts receivable is critical to sustaining growth, managing liquidity, and maintaining control across entities, while keeping bad debt at acceptable level. Manual AR and dunning processes can no longer keep pace with the complexity and reporting demands of modern organizations.

Key Takeaways for Mid-Market CFOs and Finance Teams - Beyond pure automation, the most valuable solutions provide consolidated, actionable insights that link AR performance directly to cash and liquidity planning:

- •

Prioritize seamless integration: Choose dunning solutions that connect in real-time with your ERP, accounting, and banking systems to ensure consistent data and eliminate manual reconciliation.

- •

Insist on group-level visibility: Ensure your platform offers consolidated AR insights at both group and subsidiary levels to support strategic cash and liquidity decisions—especially as you scale or acquire new entities.

- •

Demand automation plus flexibility: Opt for automation, but retain full control through customizable workflows, robust analytics, and real-time exception handling.

- •

Link collections directly to cash management: Select solutions that synchronize AR and payments data instantly with cash flow forecasting and treasury dashboards.

- •

Focus on controllable deployment: Evaluate time-to-value and ongoing IT impact; the right fit will deliver rapid results without heavy internal resource requirements.

Whether your objective is to accelerate collections, strengthen working capital, or enable data-driven treasury management, modern dunning platforms—especially all-in-one solutions like Agicap—can help mid-market organizations achieve real, measurable impact.

Ready to take action?

Book a demo with Agicap to see how unified AR automation and real-time cash management can help your finance team reduce DSO, improve working capital, and gain full control over group liquidity. Experience how Agicap connects your collections directly to cash forecasting—with rapid deployment and seamless integration into your existing finance systems.

FAQ About Dunning Software

What is the meaning of dunning and the dunning process in a B2B finance and AR context?

In B2B finance, dunning refers to the structured, rule-based process of following up on overdue receivables through reminders, escalation steps, and, if needed, legal actions. In practice, the dunning process covers the full sequence of actions—from initial reminders to dispute handling and possible legal recovery. Modern dunning software transforms this traditionally manual process into an automated, data-driven workflow integrated with ERP and cash management

Is there a difference between cash collection software and dunning software?

Dunning software – often described as automated dunning & reminder software – focuses primarily on automating and orchestrating the reminder and escalation process for overdue invoices. Cash collection software is a broader category that may also include proactive reminders before due date, payment portals, reconciliation, and integrations with treasury tools. In practice, many mid-market solutions combine both and act as integrated cash collection and dunning platforms.

What is dunning notification software, and how does it fit into AR automation?

Dunning notification software automates outbound communications to customers—emails, letters, SMS, or portal alerts—about upcoming or overdue invoices. In advanced AR setups, notification capabilities are just one component of a broader dunning system that also manages workflows, dispute handling, segmentation, analytics, and integration with ERP and banking data.

What is dunning letter software, and is it sufficient for modern AR teams?

Dunning letter software is designed to generate and send standardized reminder letters for overdue invoices. While it can support basic collections, most mid-market finance teams now require more than letter-based workflows: multi-channel reminders, real-time dashboards, dispute management, and strict auditability. This is why they increasingly adopt full dunning software platforms rather than standalone letter tools.

What is dunning payment software and how does it accelerate collections?

Dunning payment software connects automated reminders directly with payment capabilities, such as embedded payment links, customer portals, or integrated payment methods. By reducing friction between the reminder and the payment action, these solutions help AR teams shorten collection cycles, recover overdue amounts faster, and improve DSO without increasing headcount.

How does dunning software complement billing management and SaaS billing software?

While billing management and SaaS billing software focus on issuing invoices, managing pricing, and handling subscriptions, they do not fully address overdue receivables or failed payments caused by insufficient funds or expired cards. Many recurring‑revenue businesses use software for subscription management with dunning to handle failed subscription payments, but mid‑market finance teams typically need dedicated dunning software to orchestrate collections across all customers, entities, and payment terms.