Cash Reporting Software: Best Solutions & Practices for US Mid-Market Finance Teams (2026)

For US mid-market CFOs and treasurers, real-time cash visibility is no longer optional—it’s foundational to financial leadership. With accelerating business models and increasingly complex capital structures (PE-backed, LBO, or M&A-driven), finance teams face mounting pressure for continuous, group-wide insight into cash.

Yet most organizations still rely on manual spreadsheets or fragmented legacy tools, creating delays, errors, and missed opportunities. According to APQC’s 2025 Financial Management Priorities and Challenges Report, cash flow management and digital transformation are now among the very top priorities for US finance leaders—making real-time cash reporting more crucial than ever.

This guide defines what cash reporting software really is, details where it creates value, and explains how to evaluate and future-proof your finance reporting stack for the road ahead.

What is Cash Reporting Software?

Definition and Position in the Finance Stack

Cash reporting software offers real-time, consolidated visibility into a company’s cash positions—across every bank, legal entity, and currency—combined with automation for reporting, reconciliation, and dashboards. Unlike basic accounting software—which is designed for financial record-keeping—cash reporting software delivers actionable insights for strategic cash and liquidity management.

For mid-market finance leaders evaluating their technology stack, it’s critical to understand how cash reporting software differs from both traditional accounting tools and full-scale cash management suites. Here’s how each fits into your organization’s finance ecosystem:

- •

Cash reporting software: Enables real-time, group-wide cash visibility with automated reporting and actionable analytics.

- •

Accounting software: Focuses on transaction recording, compliance, and historical statements—typically lacks consolidated cash dashboards.

- •

Full cash management suites: Offer broader treasury functions (e.g., payment execution, advanced liquidity management, FX/interest rate risks management tools), but are often complex, costly, and harder to onboard for lean mid-market teams.

Business Impact and Typical Use Cases

Cash reporting software transforms finance operations for US mid-market CFOs and treasurers, especially those in PE-backed, M&A-active, or LBO environments, by enabling them to:

- •

Monitor in real-time cash across all banks and entities: Instantly centralize balances, spot idle cash, and optimize group liquidity—even in complex, multi-entity structures

- •

Streamline working capital and debt management: Accurately forecast cash needs, align debt payments, ensure compliance with covenants, and accelerate collections—reducing DSO and reliance on external financing, which is crucial for LBO businesses.

- •

Automate reconciliations and eliminate manual reporting: Replace labor-intensive spreadsheets and journal entries with automated workflows, freeing teams for higher-value tasks.

- •

Accelerate and secure board, sponsor, and audit reporting: Produce consolidated, audit-ready cash reports in one click, ensuring transparency and compliance for sponsors, lenders, and auditors—key for PE-backed and LBO-funded firms.

- •

Facilitate change (M&A, restructuring, growth): Seamlessly integrate new acquisitions or entities post-M&A, and rapidly adapt reporting as organizational structures or ownership evolve.

In practice, this drives more control, faster decisions, and greater confidence—whether managing daily cash, navigating a leveraged buyout, integrating an acquisition, or reporting to PE sponsors and the board.

How to Evaluate Cash Reporting Software for US Mid-Market Companies

Critical Capabilities Checklist

To meet the demands of PE-backed or fast-growing mid-market companies, your cash reporting platform must include:

- •

Real-time, multi-bank and multi-entity cash visibility: All accounts and legal entities, US and international, centralized on intuitive dashboards.

- •

Automated bank, ERP, and accounting software integrations: Live data feeds, seamless reconciliation, no more spreadsheet imports.

- •

Rolling forecasts and variance analysis: Drill-down, scenario planning, easily updated as conditions change.

- •

Debt and intragroup financing management: Track and optimize internal and external financing, automate interest calculations, and anticipate debt servicing needs.

- •

Customizable dashboards and reports: Exportable, mobile-ready, suitable for management, auditors, and boards.

- •

Advanced governance & security features: Robust permissioning, audit trails, compliance-ready reporting—all scalable for organizational growth and complexity.

Practical Vendor Evaluation Criteria

Beyond product features, successful deployment depends on:

- •

Rapid implementation and expert support:Experience fast, efficient implementation with dedicated onboarding support.

- •

Transparent, modular pricing: Avoid rigid “one-size-fits-all” licenses—pay only for usable, valuable features.

- •

Superior usability and mobile access: One seamless platform, intuitive for all users; true real-time insights even on the go.

- •

Proven references: Real-world results from US mid-market companies with needs similar to yours.

Comparison Snapshot—Top 8 Cash Reporting Software 2026

Provider | Core Features | Strengths | Best Fit For |

|---|---|---|---|

Agicap | Real-time multi-bank/entity dashboards, cash pooling, rolling forecasts, automated reconciliation, debt & intragroup management, mobile app, native ERP / accounting / bank integrations | Advanced & intuitive reporting, mobile app, all-in-one platform, fast deployment | US mid-market, PE-backed, multi-entity groups prioritizing agility and usability |

Trovata | Real-time cash visibility, multi-bank APIs, basic forecasting, automated reporting | Bank connectivity, intuitive UX, rapid rollout | Growing mid-market / SMBs needing quick bank integration |

Kyriba | Full treasury suite: cash, payments, risk, FX, forecasting, ERP / accounting / bank integrations | Advanced functionality, global coverage | Large / enterprise or complex mid-market with dedicated treasury resources |

HighRadius | Cash visibility, AR / AP automation, AI-based forecasting, ERP / accounting integration | AR / AP automation, AI analytics | Upper mid-market with heavy receivables volume |

Planful | Financial planning, cash reporting, forecasting, dashboards, ERP / accounting integration | FP&A focus, scenario modeling | Mid-market seeking unified planning & reporting |

Sage Intacct | Cash management, reconciliations, reporting (native to Sage), ERP / accounting integration | Embedded for Sage users, finance automation | Sage ERP customers needing basic cash reporting |

NetSuite | Cash management, reporting, dashboards, NetSuite-native integration | Seamless with NetSuite, broad ERP / accounting functions | NetSuite clients favoring integrated ERP + cash |

TIS | Cash visibility, bank connectivity, payments, reporting | Bank connectivity, global payments | Mid-market/enterprise with complex bank/payment needs |

Solution Mini-Profiles

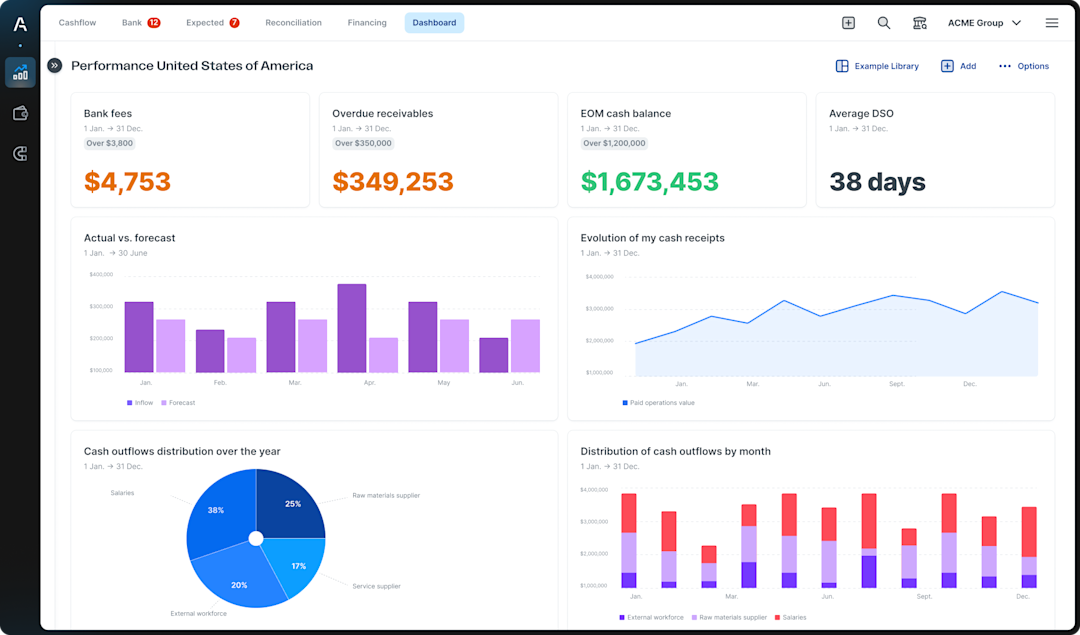

Agicap

Purpose-built for US mid-market and PE-backed companies needing rapid deployment, all-in-one cash visibility, automated reconciliation, and mobile-first dashboards. Stands out for intuitive UX, and unified group reporting—ideal for fast-scaling, multi-entity environments.

Key features:

- •

Real-time, customizable cash dashboards (web & mobile)

- •

Centralized multi-bank, multi-entity visibility

- •

Automated bank/ERP/accounting integrations and reconciliation

- •

Rolling 13-week+ cash forecasting with scenario analysis

- •

Debt and intragroup loan management (with interest calculation)

- •

Instant, audit-ready and configurable reporting

- •

Advanced mobile app with push notifications and daily/weekly insights

- •

Secure, scalable SaaS with full audit trail and permission controls

Trovata

Strong in real-time multi-bank aggregation and automation, designed for growing SMBs and mid-market firms that value API-driven workflows and a modern, cloud-native interface.

Focused primarily on liquidity insights and reporting but with fewer advanced forecasting and group treasury tools than specialist solutions.

Kyriba

Enterprise-class treasury suite with robust global coverage, advanced risk management, payments, and FX modules.

Powerful for organizations with deep treasury needs and IT resources, but implementation is lengthier and user adoption may be slower in lean or fast-paced environments.

HighRadius

AI-driven solution specializing in AR/AP automation and cash application, boosting straight-through processing and working capital efficiency.

Well-suited to companies handling very high invoice volumes or prioritizing collections automation; broader cash visibility or advanced group reporting may require add-ons.

Planful

FP&A-centric platform offering integrated financial planning, budgeting, scenario modeling, and consolidated cash reporting.

Great for finance-led teams looking to unify planning and reporting, though less comprehensive for complex treasury workflows or multi-bank environments.

TIS

Best known for strong international bank connectivity and secure global payments management.

Ideal for organizations needing deep payment hub functionality across currencies and entities; some firms may layer on separate tools for advanced cash analytics.

NetSuite Cash Management

Built directly into the NetSuite ERP, providing dashboards, reconciliations, and basic cash insights for NetSuite customers.

Most beneficial for mid-market/enterprise users fully invested in NetSuite; less powerful for group-wide visibility or outside the NetSuite ecosystem.

Sage Intacct Cash Management

Natively integrated into Sage Intacct ERP, supporting core cash visibility, reconciliations, and payment management.

A practical extension for Sage users with straightforward cash management needs, but less robust for rolling forecasts or consolidated multi-entity analytics.

Deploying Your Cash Reporting and Cash Flow Management Software: Best Practices

Deploying a modern cash reporting platform or cash flow management software in a mid‑market context isn’t just an IT rollout—it’s a lever for value creation across your entire finance stack. In practice, cash reporting platforms are often the backbone of cash flow management software, providing the real-time data and visibility required for effective decisions. The following best practices are drawn from real‑world deployments in PE‑backed, M&A‑active, and fast‑growing organizations.

1. Prioritize Data Quality and Integration for Group-Wide Impact

- •

Best Practice: Standardize cash structure and clean datasets across all entities at the very beginning of deployment. Build bank integrations and ERP / accounting connectors at group level to centralize reporting and visibility.

- •

Business impact: This approach enables you to unlock previously “trapped cash”, support cash pooling, and confidently mobilize surplus for investment.

2. Design for Scalability Across M&A, Growth, and Group Structures

- •

Best Practice: When configuring the tool, anticipate future M&A activity, post-merger integration (PMI) and changes in group structure from the beginning. Set up flexible workflows, user roles, and scenario models so the platform grows with you.

- •

Business impact: Facilitates rapid integration of acquisitions, reduces onboarding time for new subsidiaries (e.g., from months to weeks as in Milexia).

3. Activate Cross-Functional “Cash Culture” and Daily Usage

- •

Best Practice: Appoint cash champions in HQ and each subsidiary. Involve AP/AR, FP&A, and treasury in training, and encourage daily use of dashboards, variance analysis, and scenario planning features—not just monthly reporting.

- •

Business impact: Fosters accountability and shared ownership of liquidity management (as at Milexia, where both holding and local CFOs rely on Agicap daily), accelerating DSO reductions, reducing overdue, and improving EBITDA-to-cash conversion.

4. Automate to Enhance Efficiency and Free Up Talent

- •

Best Practice: Prioritize automation of accounting processes (journal entry creation, reconciliations), collections, and reporting. Make automation the standard, not a future upgrade.

- •

Business impact: Cuts manual workload, reduces operational risk, and allows the team to focus on analysis, scenario fine-tuning, and strategic business support rather than low added value tasks.

5. Align Reporting with Stakeholder Expectations (PE Funds, Lenders, Board)

- •

Best Practice: Proactively design dashboards and reports meeting sponsor, lenders (covenant compliance), and board needs. Accelerate your investor reporting cycle—moving from weeks to days—and provide stakeholders with transparent, audit-traceable exports.

- •

Business impact: Builds trust, facilitates negotiations for better financing terms, and directly strengthens exit readiness.

6. Track Ongoing Performance and Demonstrate Value

- •

Best Practice: Monitor KPIs such as forecast accuracy, DSP, quick ratio, and realized savings. Iterate and celebrate improvements with the whole team.

- •

Business impact: Ensures continuous optimization, greater sponsor/board confidence, and cements a sustainable, “cash-first” discipline well beyond initial deployment.

By putting these best practices in place, mid-market finance teams harness cash reporting software as a true engine of financial agility, operational efficiency, and enterprise value—transforming treasury from a compliance cost center into a strategic value driver.

For a deeper dive, see Agicap’s Playbook: 10 Best Practices to Boost Your Company’s Cash Performance – Guide for a Cash-First Mindset (2024).

Agicap in Focus—A Benchmark for US Mid-Market Success

Strategic Differentiators

- •

Lightning-fast, low-IT implementation: Go live in weeks with minimal internal IT involvement, thanks to tailored, expert-led onboarding and a SaaS-native platform.

- •

Unified, real-time dashboards (web & mobile): Instant, group-wide cash consolidation and drill-down analytics—no exports or third-party tools needed.

- •

All-in-one, cloud-based platform: Manage cash reporting, forecasting, debt, and intragroup flows in a single workspace—unlike platforms such as Kyriba, which often require fragmented modules, external dashboards (PowerBI), or complex setups.

- •

Superior usability and adoption: Modern, finance-team-friendly interface designed for daily use and mobile access—eliminating the complexity and steep learning curves typical of legacy TMS solutions.

- •

Outstanding support: Dedicated experts with rapid response—by phone, chat, or email.

Customer Success Story (Automotive Manufacturer, LBO Context)

A lean finance team in a $40M LBO-driven group automated cash reporting with Agicap, centralizing real-time dashboards for all 9 bank accounts and two entities. They digitized bank reconciliations, automated journal entries, accelerated cash collections, and integrated all debt schedules for streamlined forecasting and reporting to management, sponsors, and lenders.

Results:

- •

Overdue receivables cut by $1.1M

- •

3 hours saved daily through bank journal automation

- •

Centralized, audit-ready reporting to banks, sponsors, and management—improving trust and discussion efficiency

- •

Debt monitoring and cash forecasting streamlined across 2 entities and 9 bank accounts

In the CFO's words:

“Centralizing all debt lines in Agicap allows us to monitor our outflows with confidence and streamline reporting for the banking pool.”

Future-Proofing Cash Reporting—2026 and Beyond

Key Tech Trends for Forward-Looking Finance Teams

- •

Open Banking & APIs: Seamless, secure data integrations with banks and financial institutions—enabling true real-time, consolidated cash visibility across all group entities.

- •

AI-Driven Cash Insights: Predictive analytics and intelligent forecasting tools that drive faster, data-backed liquidity decisions, early risk detection, and ongoing performance optimization.

- •

Mobile-First & Self-Service Reporting: 24/7 access to real-time dashboards and customizable reporting, empowering decentralized teams and executives to act with confidence from anywhere—without IT bottlenecks.

The Power of End-to-End Integration

Future-ready finance teams recognize that value comes from consolidating cash reporting, forecasting, and liquidity management within a single, unified platform. End-to-end integration breaks down silos, eliminates manual handoffs, and ensures accuracy and control—delivering the level of insight and reactivity required for modern growth, M&A cycles, and PE-backed environments.

Want to see how future-ready cash visibility can transform your finance function?

Book a demo with Agicap today and discover how we help mid-market teams unlock agility, control, and confidence for 2026 and beyond.

FAQ About Cash Reporting Software

What is cash reporting software, and why is it vital for mid-market companies?

Cash reporting software consolidates all your cash positions in real time across banks, entities, and currencies. Mid-sized firms rely on it for reliable liquidity insight, risk reduction, and proactive decision-making.

What is the best way to monitor cash?

The best way to monitor cash is to use dedicated cash reporting software that connects directly to all your banks and entities, and consolidates balances in real time on a single dashboard.

For mid‑market finance teams, this is more effective than relying on ERP screens or spreadsheets because it lets you:

- •

See all bank accounts and entities at once (multi‑bank, multi‑currency, multi‑entity)

- •

Track daily movements and trends instead of waiting for month‑end

- •

Set up alerts and views by entity, business unit, or covenant requirement

In practice, specialized cash reporting platforms provide the most reliable, scalable way to monitor cash for growing US mid‑market groups.

What is the difference between cash reporting software and cash flow management software or cash flow tools?

Cash reporting software focuses on real-time, consolidated visibility of all cash balances across banks, entities, and currencies, with automated feeds and dashboards for daily decisions. Cash flow management software or generic cash flow tools often emphasize budgeting, projections, or basic cash-in/cash-out tracking, sometimes at a single-entity level and sometimes with “lite” or free features.

For mid-market groups, cash reporting software is designed for multi-bank, multi-entity liquidity oversight, while cash flow tools are typically better suited to simpler, single-entity use cases.

How does cash reporting software differ from FP&A software or financial forecasting services?

FP&A software and financial forecasting services are built to manage budgets, P&L, balance sheet, and long-term scenarios at a group level. Cash reporting software, by contrast, is centered on daily cash positions and short- to medium-term liquidity, consolidating bank data in real time.

In practice, many mid-market finance teams use both: FP&A tools for strategic planning and performance management, and cash reporting software for operational liquidity control and real-time treasury decisions.

What are the best solutions for monitoring multiple bank accounts and real-time cash visibility?

The best solutions for monitoring multiple bank accounts and achieving real-time cash visibility are specialized cash reporting platforms that:

- •

connect directly to all group banks,

- •

consolidate balances by entity, currency, and bank,

- •

provide dynamic dashboards and configurable alerts.

For US mid‑market companies, it’s critical to choose software designed for multi‑bank, multi‑entity environments, rather than relying solely on ERP screens or manual Excel exports.

Can cash reporting software also support cash allocation and cash optimization?

Yes, to a large extent. By providing a consolidated view of balances and forecasts by entity, bank, and currency, cash reporting software gives finance teams the information they need to:

- •

allocate cash (repay debt, fund subsidiaries, invest surplus cash),

- •

identify idle or trapped cash,

- •

make trade‑offs between credit lines, cash pooling, and short‑term investments.

In very complex environments, it may be complemented by a broader cash management system, but for many mid‑market groups, a robust cash reporting platform already covers most day‑to‑day cash allocation and optimization needs.