How cash flow forecasting software transforms financial planning

There’s a real financial toll on CFOs trying to manage cash without the right cash flow software. One of the most damaging challenges for mid-sized companies is the lack of accurate forecasting, both in the short and long term.

Without reliable cash flow forecasting software, many US mid-sized businesses are leaving serious money on the table. According to Agicap’s 2025 Mid-Market Survey, the average cost of inaccurate forecasts reaches $465,000 annually. Even more alarming: 43% of US mid-market companies face an unexpected cash shortfall of over $50,000 every 20 days. The biggest culprits? Poor inventory management, underestimated operational complexity, and reliance on outdated tools like spreadsheets. Unsurprisingly, forecast accuracy suffers most when businesses scale across multiple legal entities, currencies, and bank accounts. In today’s high interest rate environment, these weaknesses don’t just hurt liquidity, they threaten long-term resilience.

If companies can’t rely on their cash flow projections, how can they make confident, strategic decisions?

What is cash flow forecasting software?

Cash flow forecasting software ensures that businesses can make accurate predictions about their cash position. That means knowing what the situation is going to be tomorrow, as well as far into the future.

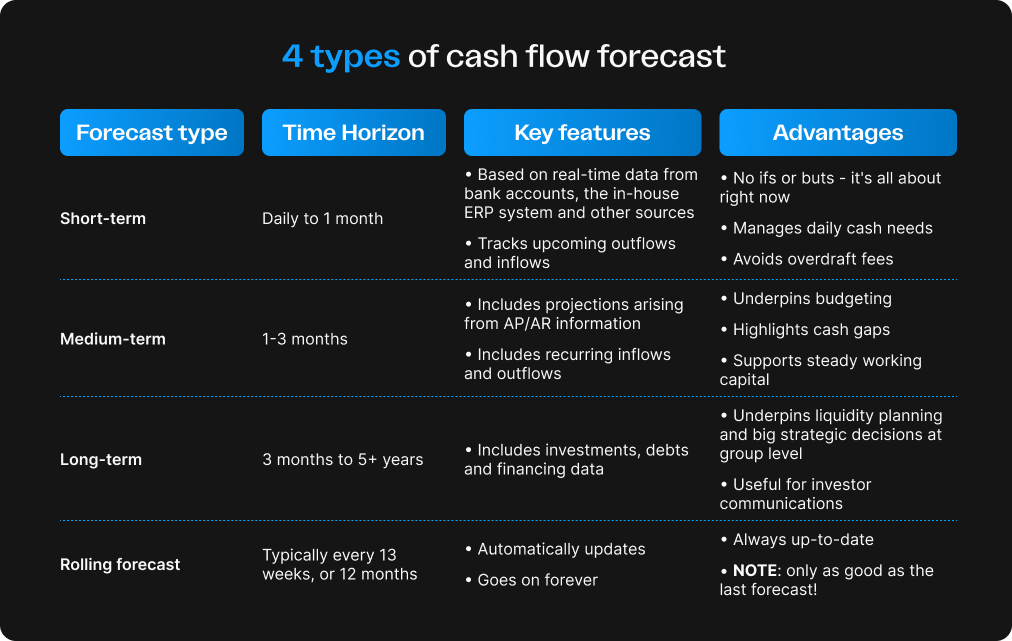

- Short-term cash flow forecasts mean businesses get better visibility on their cash. This means they can make better decisions around where cash needs to go, resulting in numerous efficiencies with inflows, outflows and balancing operations.

- Long-term cash flow forecasts allow for liquidity forecasting - ie. ensuring the business will have enough money to pursue its long-term goals - which, in turn, underpins all top-level financial planning.

Desktop cashflow forecasting is the most powerful format for business cashflow software, with smartphone forecasting apps providing a leaner level of support for team members on the move.

Cash flow forecasting software can be provided as an add-on module to existing business cash flow software, or - as with Agicap - be a powerful central element.

Key features of modern cash flow projection software

Here are ten key features of top cash flow forecasting software:

1. Real-time cashflow data visibility

The Holy Grail that every CFO and CEO seeks: what is our exact cash position right now? Many cash management solutions promise it. Agicap is certainly one solution that actually delivers it, and that's down to the whole package being orientated around cash rather than in-depth Treasury risk management functions, for example, or massively complex spend management provision.

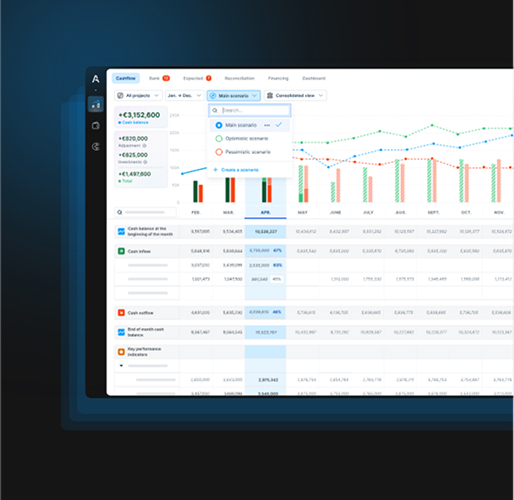

2. Forecast using scenarios

Scenario planning in cash forecasting means finance teams can plot best and worst case scenarios, and see what the outcomes for cash would be in the short, medium and long-term. A great feature available on advanced cash management platforms, and ideal for stress-testing.

3. Automated integration of data

Without connecting to other accounting tools as well as in-house ERP systems, a cash flow forecasting system will not have much data to go on. For rolling forecasts and live cash position updates, the cash flow projection module needs to be refreshing data feeds continuously.

4. Management of multiple entities

The larger accounting packages (as well as ERP systems) offer the ability to consolidate finances across a group. Software like Agicap allows you to switch - with one click - from a consolidated group view to a detailed view of each entity's cashflow.

5. Cash flow categories and tags

Teams can customize their own cash flow projections with unique tags for inflows and outflows (marking up rent, payroll, payments from a particular client etc.) The top forecasting packages make this easy with drag-and-drop tools.

6. Import/export flexibility

Whilst Excel spreadsheets may be time-consuming dinosaurs, companies still use them and need them. Top cash flow forecasting software makes it easy to import any spreadsheet, as well as customise exported reporting formats. The more advanced the software, the more ways there typically are to bring in and send out data formats.

7. Alerts

Set desktop alerts for significant changes in key levels; including high variance between actual and expected inflows and outflows, delayed payments, low cash levels etc.

8. Custom dashboards

Want to create particular financial perspectives and freeze them in time? No problem with custom dashboards. With packages like Agicap that are heavily-invested in collaboration tools, you can:

- First set up a custom dashboard view on any of a variety of topics (banking pool, cash burn, variance, indebtedness, investments, DSO etc)

- Then access the dashboard from the Agicap mobile app on your smartphone ...

- Or share the dashboard electronically with any stakeholder

9. Multi-currency support

If your business (or group of business entities) is juggling various currencies, look for automatic currency conversions and consolidation - as well as exportable exchange rates for transparent auditing.

10. Rolling forecasts

You might think that rolling forecasts come as standard, but they do not. With the more powerful cashflow forecasting systems, forecasts automatically update as new data arrives as well as extends its own temporal scope.

Benefits of using cash flow forecasting software

There are tactical and strategic benefits to using forecasting software.

Strategically, it is impossible to make informed decisions about company/group direction without having a clear view of the future financial landscape. This view will not be perfect. But, without it, the CEO and Board cannot plan key strategic actions (like M&A or changes in market focus) or financing actions like taking on debt/making investments.

Tactically - ie, in the area of day-to-day operations - cash flow forecasting creates numerous efficiencies in terms of optimizing cash allocation across the whole company. Naturally too, overdraft fees are avoided and, with cash surplus identified and pooled, investment opportunities can be taken.

Types of cash flow forecasts (short-term vs long-term)

How to choose the right solution for real time cashflow forecasting

- Assess your business size, complexity and existing tech stack.

- Identify a software solution that is compatible with your accounting and ERP systems.

- Prioritize solutions with customizable dashboards, collaborative features and scenario planning; as these are universally useful features, whether your business needs them right now or not.

- Pivot on whether you need multi-entity management or not; if so, you need to go with an established expert in this field (like Agicap), or an enterprise-scale solution that will offer the management of multiple entities as standard.

- Evaluate pricing and scalability.

- Trial a few platforms to see what works.

- Implement your chosen solution - prioritising firms that offer real implementation support and training.

Cashflow management software: best practice for implementation

It is a lot easier to implement Agicap than a traditional Treasury Management Solution. And, whereas a TMS might offer more depth on commodities and currency risk, Agicap's centering of cash makes it hugely popular outside of Treasury with CEOs, CFOs and Finance and Accounting Teams. For Agicap, cash is king - and that works for everybody.

When it comes to implementation, Agicap might take 3-6 months to install and integrate, as well as train key employees. A traditional TMS might take double that. What's more, Agicap's support system centres around a dedicated account manager with average response times to tech queries of less than 2 minutes.

How do I do a cash flow forecast?

Once Agicap is up and running, one of the easiest ways to produce a cash flow forecast is to use the Agicap P&L conversion module.

Just a few simple clerical steps will get this set up - like linking the categories in your P&L to Agicap categories and eliminating non-P&L lines like depreciation and amortization. Once your bank accounts are synchronized, you will over time be able to compare your budget with what really happened and identify variance hotspots.

Discover how Agicap can transform your cash flow planning by watching this video.

Why use Agicap rather than Excel for cash flow forecasting?

Excel may still be widely used for cash flow forecasting — 26% of companies surveyed in 2024 continue to rely on it — but that doesn’t make it the right tool. Manual input, error-prone formulas, and static data make Excel an outdated solution for today’s dynamic cash management needs. It simply wasn’t built for real-time financial planning, multi-entity visibility, or collaborative scenario analysis.

Agicap offers a smarter, more scalable approach. Instead of spending hours maintaining fragile spreadsheets, finance teams can streamline and automate their forecasting with Agicap — gaining real-time syncing, automated data consolidation, and accurate projections. For teams that aren’t ready to fully part ways with Excel, Agicap’s dedicated plug-in makes it easy to connect your spreadsheets and gradually upgrade your workflow — without losing existing data.

Agicap integrates seamlessly with:

- Spreadsheet software.

- File storage systems.

- Payment solutions (like PayPal, Stripe and Adyen).

- Spend management software (like Spendesk, Zoho Invoice and Pleo).

- 1000s of banks.

- Major accounting software and ERP systems (like SAP, Xero, Quickbooks, Sage and Oracle).

Unlock your business’s cash flow potential with Agicap

Has your business got enough cash right now? In today’s environment, you would have thought that basic cash management would be easy with the right software. But according to Agicap’s 2025 survey, 43% of US mid-market companies still face unexpected cash shortfalls of over $50,000 every 20 days. This is what happens when businesses lack a powerful cash flow forecasting solution. Fortunately, Agicap delivers exactly that.

AI-powered cash flow prediction

Brought together by powerful machine learning, Agicap provides the most comprehensive approach to cashflow planning that's on the market.

That's because Agicap bases its cash flow forecasting on both direct and indirect methods.

Direct forecasting: from ERP systems comes data based on supplier and client invoices, purchase orders and quotes; debts, investments and payments; aggregation from bank accounts as well as reconciliation with treasury operations.

Indirect forecasting: data used here comes from budgets and our P&L-to-cash converter, and is interpreted using AI and other key cashflow prediction modalities.

On this comprehensive data basis, Agicap can provide a three-tiered perspective for the best cash flow forecasting:

- Short-term cash positioning: daily visibility, weekly or monthly horizon

- Medium-term forecasting: 13-week forecast, weekly visibility, quarterly horizon

- Long-term cash flow plan: monthly/quarterly visibility, yearly horizon

Real-time cash flow data monitoring

Agicap provides real-time cash flow monitoring by syncing with bank accounts and integrating with accounting systems. This enables businesses to make informed decisions based on up-to-date financial data, essential for effective financial planning.

SmarterTravel, a fast-growing travel-tech company in Cambridge, faced cash flow challenges due to its business model. With payments collected upfront for hotel bookings but delayed payments to suppliers, managing cash flow manually became inefficient and error-prone.

After implementing Agicap, SmarterTravel's VP of Finance, Sayanthan Bhowmick, significantly reduced the time spent on cash flow management, from several hours per week to just minutes a day. Agicap’s integration with QuickBooks and bank transactions provided real-time, accurate cash flow insights, empowering the company to make data-driven financial decisions.

Automated data integration & cash flow optimization tools

Finance teams like Agicap because there is limitless potential to unify forecasting data. On one single interface, you can:

- Bring together data from operations, financing and investments.

- Take data from multiple business entities and consolidate it at group level.

- Connect your spreadsheets using Agicap's dedicated plug-in.

- Use our dedicated converter software to transform your forecasted P&L statement into the basis of a cash flow forecast.

Multiple scenario planning

A strong suite of Agicap recognized in the industry is our provision of customizable forecasting models. Your finance team can do more than get forecasts based on real-life inputs. You can create and test fictional scenarios to gain valuable intel on possible opportunities and risks: What happens if we hire new staff? Enter this new market? What is the best case for our profitability this year, as well as the worst case?

And to hone your accuracy, Agicap gives you powerful tools to compare actual vs. forecast figures. Your team can build custom dashboards showing your variance analysis so your CFO can explain to the Board exactly what is happening.

Ready to take control of your cash flow?

Unlock the full power of your financial data with Agicap. Whether you're managing daily operations or planning long-term growth, Agicap's advanced forecasting tools empower you to anticipate financing needs, improve accuracy, and adapt in real time. With features like scenario planning, real-time updates, and seamless integrations, you'll have everything you need to make confident financial decisions. Don’t let uncertainty hold your business back—start optimizing your cash flow today with a free custom trial.