Cash Flow Forecast Guide 2026 : How US Mid-Market Companies Achieve Accurate, Group-Wide Visibility

For CFOs, VPs of Finance, and Treasurers in US mid-market companies, mastering cash flow forecasting is now a critical capability—not just a routine. The stakes are high: according to Agicap’s 2025 survey of US mid-sized companies, the average cost of unreliable cash flow forecasts amounts to $465,000 annually. Even more concerning, 43% of US mid-market companies admit to relying on unreliable forecasts—leading to unexpected cash deficits of over $50,000 every 20 days on average.

As organizational complexity increases and the gap between strategic planning and operational realities widens, finance leaders are expected to deliver forecasts that are reliable, dynamic, and audit-ready. This Cash Flow Forecast Guide provides actionable strategies and best practices for transitioning from fragmented spreadsheets to unified, group-wide cash visibility—empowering your team to anticipate risks, seize opportunities, and build lasting stakeholder confidence.

Why Cash Flow Forecasting is Strategic for US Mid-Market and PE-Backed Groups

Today’s Unique Mid-Market Challenges

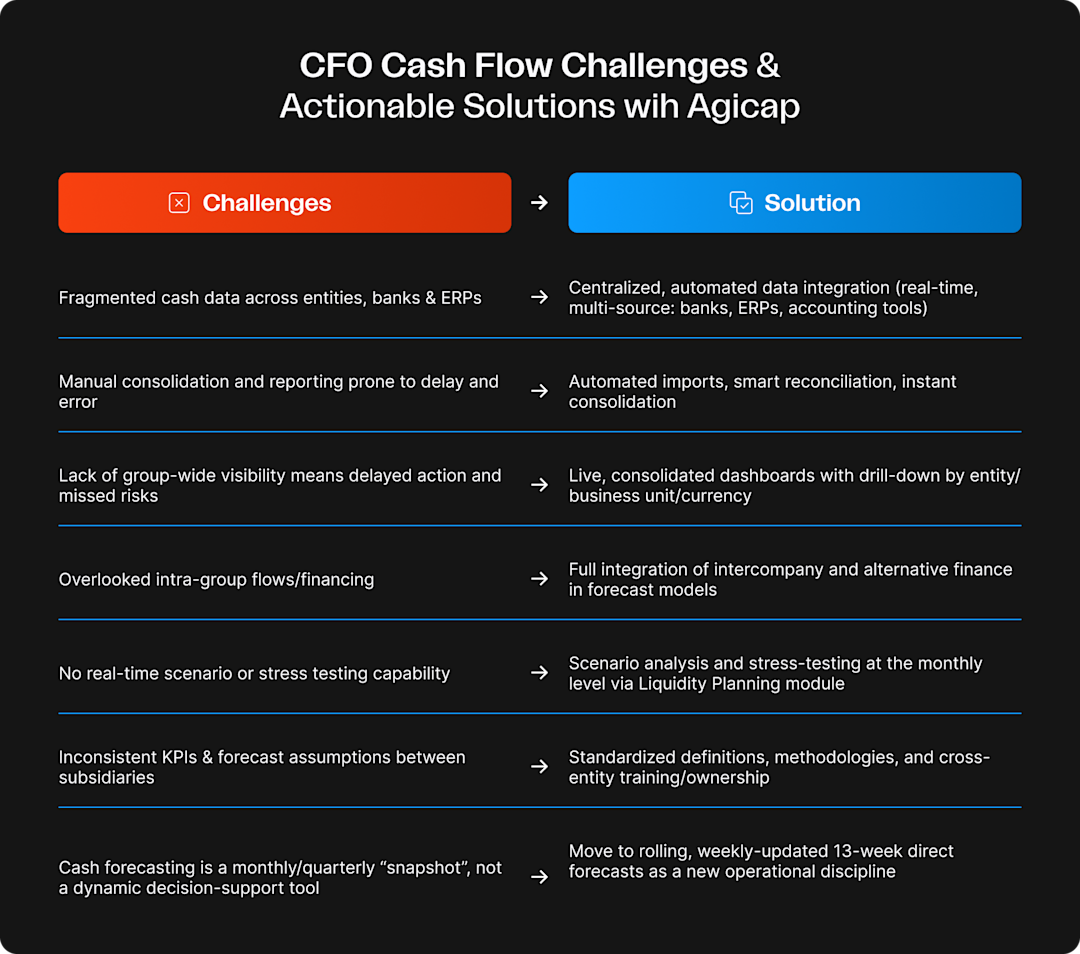

US mid-market groups—especially those with multi-entity structures and cross-border cash flows—operate in environments where information is often fragmented across various ERPs or accounting tools, banking platforms, and local processes. This fragmentation, combined with operational delays in consolidating data, limits finance teams’ ability to provide timely, group-level cash visibility.

The level of scrutiny and reporting frequency required also varies according to stakeholder profile. Private equity sponsors may expect detailed cash reports and scenario updates as frequently as weekly to drive value creation and monitor performance. Lenders, on the other hand, often require monthly reporting to track covenant compliance and assess liquidity risk. Boards of Directors typically review cash and liquidity data on a monthly or quarterly basis, geared toward oversight and strategic planning.

As a result, finance teams must balance these differentiated stakeholder expectations—ensuring that consolidated, reliable cash insights and scenario capabilities are always available, whether for regular internal analysis or for high-stakes dialogues with investors, lenders, and the board.

Where Legacy Methods Fail & Stakeholder Demands Have Changed

Traditional spreadsheet-based and manual processes quickly reach their limits in complex, multi-entity group settings:

1. Overlooked intercompany flows and off–balance-sheet financing:

Legacy tools rarely provide consolidated visibility on intra-group loans, treasury center activities, or alternative financing arrangements such as factoring and supply chain finance. The lack of integrated tracking can lead to cash being double-counted or missed entirely, reducing the reliability of consolidated cash positions and undermining group-level decision making.

2. Missing working capital KPIs at the subsidiary level:

Without real-time DSO, DPO, or aging analytics per entity, CFOs cannot confidently optimize collections or payables, leaving cash trapped and strategic decision-making impaired.

3. Inadequate audit trails:

When assumptions and changes aren’t tracked systematically, justifying numbers in front of private equity sponsors or lenders becomes time-consuming and can slow or jeopardize refinancing.

4. Lagging scenario analysis:

With data scattered and updates manual, requests from the board for stress tests (e.g., payment delays, FX exposure) lead to slow or inconsistent answers, damaging credibility and reducing agility.

5. Lack of Harmonized Category Structures for Consolidation:

When each entity uses its own chart of categories for cash inflows and outflows, group-level consolidation becomes unreliable or even unworkable. Disparate category structures—often a byproduct of multiple ERPs and local practices—lead to inconsistency, manual mapping errors, and reduced comparability of KPIs across entities. Without a standardized, shared category structure, group-wide reporting, scenario analysis, and audit trail integrity are all compromised.

In short: These blind spots directly constrain effective liquidity management, undermine trust during key transactions (such as M&A or refinancing), and expose the group to preventable financial risks—including cash shortfalls caused by double-counting or missed flows, suboptimal financing decisions, covenant breaches driven by unreliable forecasts, and delays or penalties linked to audit and reporting weaknesses.

This challenge is by no means limited to mid-market groups. As noted in a EY-Parthenon 2024 report, an analysis of 2,400 global corporates highlights that even the largest organizations struggle to achieve cash forecasting accuracy, with “cash forecasting guidance regularly underperforming compared to revenue forecasts”—leading to high buffer liquidity and costly inefficiencies.

Cash Flow Forecast Definition: Focus on the 13-Week Rolling Forecast

A cash flow forecast projects cash surpluses and shortages on a daily view for the next 4 weeks, weekly for the next 13 weeks, and monthly for the next 12 months.

The 13-week rolling cash flow forecast is a specific format that has become the industry gold standard. This medium-term horizon strikes the ideal balance: it is long enough to spot emerging liquidity risks and shortfalls, yet close enough to daily operations for actionable accuracy.

Defining the 13-Week Rolling Cash Flow Forecast

- •

Objective: Identify and manage upcoming cash surpluses or gaps and equip teams for sound operational decisions, including tactical investment and funding.

- •

Time Horizon: Rolling 13 weeks (approximately 90 days)—the preferred horizon for group cash control, covenant monitoring, and working capital optimization in mid-market environments.

- •

Data Inputs: Draws on both internal and external operational data—supplier and customer invoices, open purchase orders, actual and forecasted payment terms (e.g., DSO per client), debt schedules, and all recurring or exceptional transactions across the group.

- •

Frequency: Refreshed daily or weekly to remain aligned with operational realities and upcoming commitments.

- •

Method: Direct method only—projections are built on tangible, scheduled cash events, not indirect budget or accrual models.This ensures the numbers align with the practical realities of when money will hit or leave the bank accounts.

Expert note: Where the long-term FP&A forecast is indirect, accrual-based, and designed for strategic planning, the 13-week cash flow forecast is operational, real-time, and fully grounded in day-to-day financial activity. For group treasurers and CFOs, it is the real decision-making tool—guiding tactical investments and short-term financing that protect both liquidity and credibility.

Want to learn more about the practical differences between FP&A and cash management, and how to connect these two disciplines? Read our in-depth guide: FP&A Budgeting vs Cash Management: What’s the difference and how should finance teams link them?

Best Practices for Cash Forecasting in Treasury

Forecast Horizons & Methodology—Aligning Objectives and Data

Building a reliable, actionable cash flow forecast requires matching your approach to your time horizon and business challenge.

- •

Short-term (3–15 days, daily):Uses a direct, transaction-level method based on real-time bank activity and scheduled payments. This daily view ensures robust liquidity management and operational agility, empowering teams to confidently execute payments and respond rapidly to unexpected shortfalls.

- •

Medium-term (4–13 weeks, weekly): The CFO’s Favorite : Still direct, but integrating expected flows from ERP, invoices, purchase orders, actual DSO per client, and debt deadlines in addition to recurring items (rent, wages, etc.). The weekly, group-level forecast uncovers upcoming liquidity risks and working capital gaps—enabling proactive scenario planning and tactical funding or investment moves. Why 13 weeks? It’s precise enough for controlling cash, yet gives enough runway to anticipate and act ahead of issues.

- •

Long-term (12–18+ months): Driven by the indirect, accrual-based method (FP&A budgets, P&L, balance sheets). Ideal for strategic guidance—capital allocation, board and investor dialogue—but lacks granularity for operational decisions. Models gain credibility when fed by live operational KPIs (like real DSO or AP/AR dynamics), even as their foundation remains indirect.

Expert insight: The most resilient finance functions combine these 3 horizons—using direct methods for daily cash management and indirect projections for long-term vision—to create an integrated, future-proof cash culture.

Forecast Horizons Table

Horizon | Timeframe | Method | Data Sources | Main Use |

|---|---|---|---|---|

Short Term | 3–15 days | Direct | Bank / AP / AR / Payroll | Liquidity control |

Medium Term | 4–13 weeks | Direct | ERP / Invoices / DSO / Purchase | Working capital, liquidity risk |

Long Term | 12–18+ months | Indirect | FP&A estimates, budgets | Strategic planning |

Must-Have Components & KPIs for Group-Level Accuracy

A truly robust, group-wide cash flow forecast relies on both structural completeness and audit-ready transparency.

Essential components include:

- •

Opening Balances: Starting cash position per entity and account—serving as the foundation for all consolidated projections, and ensuring accurate roll-forwards.

- •

Receipts/Inflows: All anticipated inbound cash flows—including customer payments (segmented by business unit or geography), intra-group settlements, and any extraordinary income.

- •

Outflows/Payments: Detailed mapping of supplier disbursements, payroll, operating expenses, tax, capex, and scheduled debt service—capturing timing and magnitude at entity level for precise forecasting.

- •

Debt & Intra-group Financing: All external (bank/market) and internal (intercompany) loan commitments, with key characteristics—maturity, principal, and interest—explicitly reflected in the forecast for robust daily management and covenant monitoring.

- •

Explicit Forecast Assumptions: Agicap lets you easily create and test different forecasting scenarios by adjusting parameters such as payment behavior, seasonality, or FX impact. Each scenario can be duplicated, renamed, and updated as needed to reflect new assumptions or sensitivities.

Key Group-Level KPIs:

- •

Net Cash and Net Debt Position: Reconciled at group, entity, and currency level for a 360° liquidity perspective.

- •

Cash Runway & Liquidity Headroom: Forward-looking measures showing how much time is covered (vs. forecasted expenditures) and space to covenant limits—vital for PE, board, and lender dialogue.

- •

Working Capital KPIs: Including DSO, DPO, aging reports, and collection efficacy—highlighting cash tied up across the group and guiding targeted improvements.

Tip: Finance leaders recommend using dynamic dashboards with drill-down by business unit, entity, or currency—not only for consolidated reporting to stakeholders, but also to empower local teams to take ownership of their cash performance and quickly identify outliers.

Building and Operationalizing a Group-Wide Cash Flow Forecast

To transform cash forecasting from an ad hoc reporting task into a true management tool, organizations need to embed structured workflows and automation across their finance teams. Here’s how to build and sustain a group-wide forecasting process that supports timely, accurate decisions.

Start with Daily Smart Reconciliation: Implement a daily reconciliation process to match expected and actual cash movements for each entity and at the group level. Agicap’s smart reconciliation engine (supporting 1:1, 1:N, N:1, N:N matching) helps ensure that every inflow and outflow is correctly reflected in your rolling cash view. This daily routine is critical for maintaining accurate cash positions—you want to ensure that a payment marked as outstanding in the tool is not, in reality, already paid.

Set Monthly Forecast vs. Actual Review: At the end of each month, compare forecasted versus actual cash flows to identify significant variances. This step is key to understanding whether discrepancies come from missed/incomplete forecast entries or operational issues, and to improving the reliability of your overall forecasting process.

Streamline and Automate Data Integration: Implement real-time connections with all group banking, ERP, and accounting systems. Automate the capture of AP/AR, payroll, tax, and other recurring flows to ensure the forecast is always current, auditable, and free of manual error.

Enable Collaborative, Controlled Modeling: Centralize all forecast building and versioning in a secure cloud solution. Use granular user permissions, robust version control, and standardized methodologies (e.g., group-wide DSO rules, payment terms) to guarantee both data integrity and local adaptation.

Align Stakeholders and Governance: Establish structured workflows and regular check-ins to confirm forecast assumptions, methodologies, and reporting standards among Treasury, FP&A, Controllers, and Operations. Clear roles, definitions, and approval processes help ensure alignment and organizational buy-in.

Communicate through Flexible Dashboards: Share consolidated and drill-down cash insights via dynamic dashboards that adapt to user role—empowering group leadership and local teams to track performance and take informed action.

To bring these processes to life at scale, organizations need technology that makes them seamless and sustainable. That’s why choosing the right cash forecasting solution is crucial.

Choosing & Scaling the Right Tools — Agicap Feature Spotlight

Know What to Demand

Any treasury and cash forecasting solution for ambitious mid-market groups should provide :

- •

Real-time, group-wide cash consolidation

- •

Automated data ingestion from ERPs, banking, AP/AR, and debt

- •

Direct-method 13-week forecasting and actionable dashboards

- •

Scenario modeling, stress testing, and reconciliation intelligence

- •

Robust audit trails, version control, and secure, role-based collaboration

- •

Rapid deployment with minimal IT overhead

How Agicap Goes Further

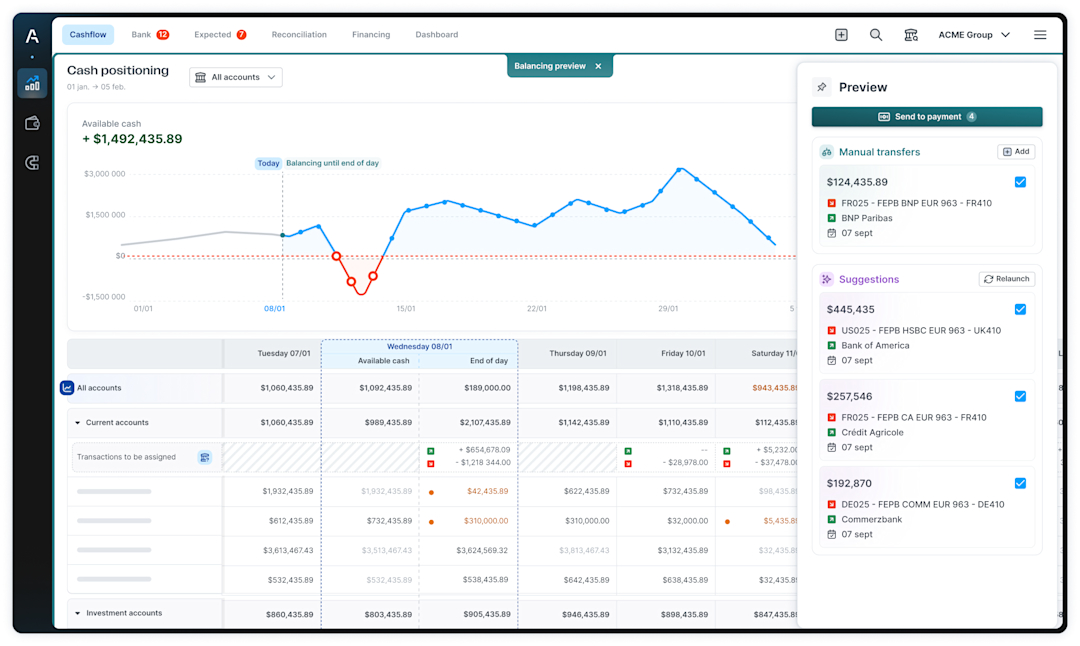

Agicap doesn’t just meet these requirements—it elevates them. Here’s how :

- •

13-Week Forecasting, Purpose-Built: Roll, update and monitor your real group-wide cash runway with weekly or daily granularity. Instantly identify shortfalls or surpluses to drive decisions—not just to report.

- •

Full Automation & Data Integration: Live feeds and ERP/AP/AR import ensure all relevant cash, debt, invoice financing and intra-group flows are captured—removing manual consolidation and error-prone exports entirely.

- •

Operational Precision with DSO by Client: Forecasts are dynamically refined by client-specific payment behavior, delivering real-world accuracy down to the subsidiary or customer level.

- •

Dynamic Scenario & Stress Testing: Instantly clone any forecast, test for delayed collections, external shocks, capex, or M&A, and see immediate P&L and liquidity impacts across entities and the group.

- •

Advanced Reconciliation Engine: Automated or manual matching (1:1, 1:N, N:1, N:N) with smart suggestions accelerates daily validation—keeping your forecast a living decision tool.

- •

Accelerated Time-to-Value: With direct onboarding by finance specialists (not generic IT integrators), Agicap is live within 3–6 months—delivering rapid ROI with minimal internal resource drain.

- •

User-First, Finance-Driven Design: A modern, intuitive interface built for finance and treasury pros means easier adoption, cross-entity collaboration, and robust control wherever the teams are working.

In summary: Agicap doesn’t just promise what’s on every RFP—it delivers operationally, at the speed and depth required by today’s US mid-market and PE-backed groups, creating real control, agility, and audit-proof reporting from day one.

From Manual Headaches to Strategic Cash Leadership

When to Move Beyond Spreadsheets

If your finance team is still spending hours consolidating group cash positions in Excel, or struggling to deliver real-time, cross-entity answers, it’s a sign you’ve outgrown manual tools. Spreadsheets may provide a starting point, but as complexity grows, so do the risks—delayed visibility, fragmented data, and increased error rates.

Get Started: Download Your Cash Flow Forecast Excel Template

For teams looking to establish or benchmark their forecasting process, we offer a downloadable Excel Cash Flow Forecast Template. It’s an ideal first step before moving to full process automation.

Case in point: Hennecke Group’s Transformation

Hennecke Group—a €160M ($180M) PE-backed manufacturer—previously dedicated four people to a full day of manual Excel-based consolidation, updating group cash visibility just once a week across five sites and multiple ERPs. For the remaining six days, finance teams had to rely on outdated data and forecasts, with no access to the real starting balance on the group’s accounts—undermining confidence in their true cash position.

By implementing Agicap, Hennecke shifted from weekly to daily cash updates, grounded in the actual opening balances pulled directly from their bank accounts. This transformation provided the team with a reliable, real-time view of liquidity every single day, replacing manual estimates with certainty. At the same time, automation slashed the manual workload from 32 hours a week down to just 2, unlocking over 1,200 hours of added-value per year.

“We’ve saved over 1,200 hours annually, minimized errors, and have real-time information at our fingertips—enabling us to focus on strategic decisions, not spreadsheet maintenance.”— Yves Souguenet, Group CFO

Delivering Strategic Value: What Next-Level Cash Forecasting Unlocks

Moving beyond manual processes isn’t just about saving time. When you embed an advanced, automated cash forecasting discipline at group level, you unlock a range of strategic benefits that elevate the finance function’s impact across the organization:

- •

Working Capital Optimization: Integrating real DSO, DPO, and customer payment behaviors into your 13-week forecast doesn’t just improve accuracy—it provides actionable levers to unlock trapped cash, prioritize collections, and optimize working capital at scale.

- •

Managing Growth, M&A, and Crisis: Built-in scenario and stress-testing allow finance teams to confidently simulate acquisitions, growth surges, or liquidity shocks. This ensures truly data-driven investment and crisis decisions—at the speed demanded by modern mid-market groups and their stakeholders.

- •

Stakeholder Trust & Investor Readiness: Regularly updated, version-controlled, and scenario-ready forecasts are no longer optional—they are a prerequisite for demonstrating credibility to boards, investors, and lender partners. Teams who standardize these best practices consistently outperform in efficiency, strategic influence, and confidence during audits or transactions.

- •

Financial Protection & Resilience: Robust forecasting shields your organization from the pitfalls of poor cash visibility—avoiding emergency borrowing at premium rates, missed supplier payments, and project delays. It also ensures you don’t leave excess cash idle, maximizing capital deployment for growth. Ultimately, strong cash discipline preserves credit quality, supports better supplier terms, and protects your market reputation.

Curious how automation can look for your group? Book a demo with Agicap

Advanced FAQs — Mid-Market Cash Flow Forecasting in Practice

What is a cash flow forecast?

A cash flow forecast is a projection of expected cash inflows and outflows, showing how much liquidity will be available at a future point in time. For mid-market groups, the operational benchmark is a rolling 13-week direct-method forecast—grounded in scheduled transactions and tailored to business complexity—rather than pure accrual/profit projections.

Why is cash flow forecasting important?

Without accurate cash flow forecasts, businesses cannot make big positive decisions about their future. How could they, when they have no idea how liquid they will be? Critically, companies which haven't been forecasting cash are vulnerable to unforeseen events forcing them to go into debt or even bankruptcy.

How do you calculate a cash flow forecast?

There are two main approaches:

- •

Direct method (recommended for 13-week, group-wide cash control): built from real bank data, scheduled AP/AR, and forecasted payments/receipts.

- •

Indirect method (for long-term, FP&A): extrapolated from P&L, balance sheet, and non-cash adjustments; less granular for daily liquidity risks.

What is a 12 month cash flow forecast?

A 12-month cash flow forecast is a long-term planning tool, usually built on the indirect method (FP&A, business plans). In contrast, a 13-week forecast is operational, used for daily/weekly risk management and decisions.

What’s the practical difference between a 13-week forecast and FP&A projections?

13-week cash forecasts capture real, scheduled cash activity for operational steering; FP&A projections are long-term, accrual-based, and strategic—not suitable for managing daily or weekly liquidity.

When is the right moment to move beyond spreadsheets?

When you’re spending significant time on manual consolidation, can’t ensure group-level control, or need improved audit trail and scenario flexibility.