How to complete a bank reconciliation

Using bank reconciliation software is the easiest way for companies to match the balance on their bank statement to the balance in their general ledger or check register. This process is generally carried out on a monthly basis.

Any differences between bank and account balances are usually due to outstanding payments, such as cheques and deposits, still in transit. Further, interest income and bank fees may be showing on the bank side of the reconciliation but not yet showing up on the company ledger.

The best bank reconciliation software - such as Agicap - identifies such unmatched transactions and offers suggestions to bring the accounts back into balance, as well as automating the entire process using banking/ERP connectivity.

Some software suites offer reconciliation as one of many cash flow management techniques available, whilst others (like ReconArt and AutoRek) specialise solely in reconciliation.

Related article:Cash management: the complete guide

What software is used for banking reconciliation?

Many suites of accounting software - such as QuickBooks, FreshBooks, and Zoho Books - have in-built bank reconciliation solutions. However, with digitalisation and automation leading the transformation in the financial industry, several companies have started offering niche reconciliation software that reconciles bank transactions and other accounting records.

Typical bank reconciliation software has the following features:

- It automates the import of banking data either directly from the bank or indirectly from other sources, such as XML or CSV files.

- It systematises transaction matching between the bank statement and the accounting records based on configurable rules.

- It generates bank reconciliation statements that detect and highlight differences and unmatched transactions between the two records.

What are the best bank reconciliation software and account reconciliation software programmes?

The easiest way to decide which bank reconciliation application is most suited to your needs is to compare features. Below, we give an overview of the six best bank reconciliation software suites:

Agicap

Agicap is not just a bank reconciliation solution—it is a complete cash management software. With Agicap, bank reconciliation is fully automated, and the same platform also enables real-time cash flow forecasting, consolidated liquidity management, and automated debt and investment tracking—all in one place.

Thanks to its connectivity, Agicap offers a time-saving and accurate solution to the problem of bank reconciliation. Agicap’s full cash management system links up in real-time with banking systems, ERP and business software. So the aggregated data from your bank account - as well as the information from your company records - is already primed when it is time to conduct bank reconciliation.

It is Agicap’s connectivity that allows it to offer bank reconciliation as one of many automated processes that produce real-time excellence in cash positioning. Grounded on reliable data intelligence, Agicap allows companies to up their game with:

- Cash flow forecasting: fully adjustable, automatic - with income statement conversion and scenario planning.

- Consolidation: let Agicap do the hard work of reconciling cash flow across your subsidiaries - complete with multiple currency management.

- Debt and investment management: centralise debt and investment data, forecast key data like interest payments and maximise investments through automated cash pooling.

“Agicap is not a nice-to-have. Agicap is a MUST.”

Thomas Haustein, Managing partner at Bau-Consult Hermsdorf

QuickBooks

Featuring among the most popular accounting software, QuickBooks boasts highly efficient bank reconciliation capabilities. It allows you to match your monthly bank statements to its check register to ensure all transactions are complete and accurate.

It offers easy tracking features such as spotting transaction errors and data changes down to dates and the users who made those changes. QuickBooks’ platform is fast, and it has recently expanded its repertoire of tools for integration.

QuickBooks is well-suited to businesses looking for a complete accounting suite, as its pricing can feel a little prohibitive for those focussing only on bank reconciliation processes.

Sage Accounting

A relatively inexpensive alternative to QuickBooks, Sage Accounting is a fairly popular bank reconciliation software with other accounting solutions. Sage bank reconciliation enables you to import invoices and receipts onto the system easily and proceeds to reconcile them with your bank transactions automatically.

It displays an automatic bank feed that presents all transactions in one place, giving you the option to choose which transactions to match by what rules. Sage facilitates its users to collaborate in real-time with their accountants, as there is no limit on the number of users.

This solution is particularly suited to small-sized SMBs looking for a convenient mobile app interface. You can try the Sage app for free for the first two months and then opt for any of its tier plans.

Xero

Xero, an excellent accounting software suite popular for its inventory and project accounting, also offers exceptional bank reconciliation features. Its interface is easy to manoeuvre, with its side-by-side layout enabling easy matching of bank transactions against accounting records and highlighting unrecorded transactions.

It allows for easy uploads of bank statements and has recently integrated the feature of statement extraction through Hubdoc. However, the bank reconciliation software does not permit the grouping of payments into bank deposits, which may make the process a little inconvenient.

Xero offers several plans, with high-tier growing and established plans offering the ability to match bulk transactions powered by AI-driven algorithms, making scaling operations easier.

BlackLine

Blackline offers comprehensive account reconciliation solutions that utilise a blend of configurable auto-reconciliation rules and standardised templates. It provides an intuitive interface that automates workflows, approvals, and reviews.

It affords complete visibility of reconciliation status through its real-time dashboards, enabling its users to focus on exceptions and make adjustments. It minimises the need for manual intervention by automating transaction matching across multiple sources.

BlackLine’s bank reconciliation services are more suited to mid-size and large companies.

ReconArt

ReconArt, a rather expensive reconciliation software, offers a one-stop solution for relatively larger SMBs requiring reconciliation services across banking transactions, trade data, credit cards, intercompany dealings, accounts, and more.

Its interface is entirely web-hosted, fully automated, and highly intuitive, but it does not offer a mobile app. It offers an auditable framework that is easy to scale in terms of users and transaction volume.

Ideally, ReconArt works best for companies that process large volumes of data or require seamless integration with third-party platforms, ERPs, and internal systems.

AutoRek

AutoRek is an end-to-end, cloud-hosted, automated bank reconciliation tool capable of reconciling data across several formats, including spreadsheets, CSV, ACH, SWIFT, ISO 20022, and other bank statement formats. It allows its users to build their own custom rules for superior matching.

It helps save costs by almost 50% through its automated reconciliation processes, easy integration with other systems, and detailed exception management. It minimises manual intervention by intelligently matching transactions and pinpointing areas for improvement.

AutoRek also offers real-time, in-depth audit trails to ensure you are FCA and GDPR-compliant. It is easily scalable and adept at handling high data volumes.

Can Excel do bank reconciliation?

Yes, bank reconciliation exercises can also be undertaken in an Excel sheet. Formulas like SUMIF, VLOOKUP, and COUNTIF help check deposits, match transactions, and identify inconsistencies between the two records.

However, Excel lacks the dedicated built-in features of bank reconciliation software that streamline and automate the transaction matching process. It is also unsuitable for businesses with huge transaction volumes that require frequent reconciliations.

Can I get a bank reconciliation template?

Freshbooks, Smartsheet and even the Corporate Finance Institute offer Excel templates for bank reconciliation.

However, companies wanting to use spreadsheets in this context might want to get a better idea of the benefits of bank reconciliation using specialised software like Agicap.

Agicap’s real-time connectivity makes spreadsheet reconciliation redundant.

A big issue with reconciliations is that bank charges may not be recorded in the company’s cash book, because the company is not yet aware of them. Likewise, deposits in transit will not be recorded.

BecauseAgicap automatically connects a company’s ERP and banking eco system and feeds live data into its own reconciliation function, this is never an issue.

Can you automate bank reconciliation?

Yes, the process of bank reconciliation is automated by the best banking reconciliation software - such as Agicap - as well as dedicated accounting software such as Quickbooks and Sage Accounting.

Automation is the first step towards a faster, more accurate reconciliation. It helps reduce the errors associated with carrying out manual reconciliations by ensuring all balance sheet accounts, including the newly-added accounts, are connected and reconciled.

Account reconciliation software minimises a company’s financial risk by reducing errors and enables time and cost savings by storing all financial data in the right place and sending timely alerts to software users for rework and exception management. They also strengthen regulatory compliance by ensuring financial reporting is aligned with policies and laws.

However, businesses must carefully evaluate their choices, as some account reconciliation software may require additional manual intervention despite purporting to be fully automated.

What accounting software has automatic bank reconciliation?

Several all-inclusive accounting software programmes, such as Xero, Quickbooks, and Sage Accounting, allow for automatic bank reconciliation and are particularly suitable for small-scale businesses. Xero offers the advantage of being easily scalable, while Sage Accounting automates bank feeds. For medium to large-sized businesses, ReconArt is a more ideal choice.

Conversely, companies with more specialised needs can opt for dedicated reconciliation software like BlackLine. For firms looking for free software tools, NCH Express Accounting is a suitable alternative. However, it is restricted to five or fewer employees and companies must buy a paid plan when they scale up.

The best banking reconciliation software - such as Agicap - integrates with your bank accounts to automatically import your transactions, providing an accurate picture of your cash flows in a few clicks.

FAQs

What is account reconciliation?

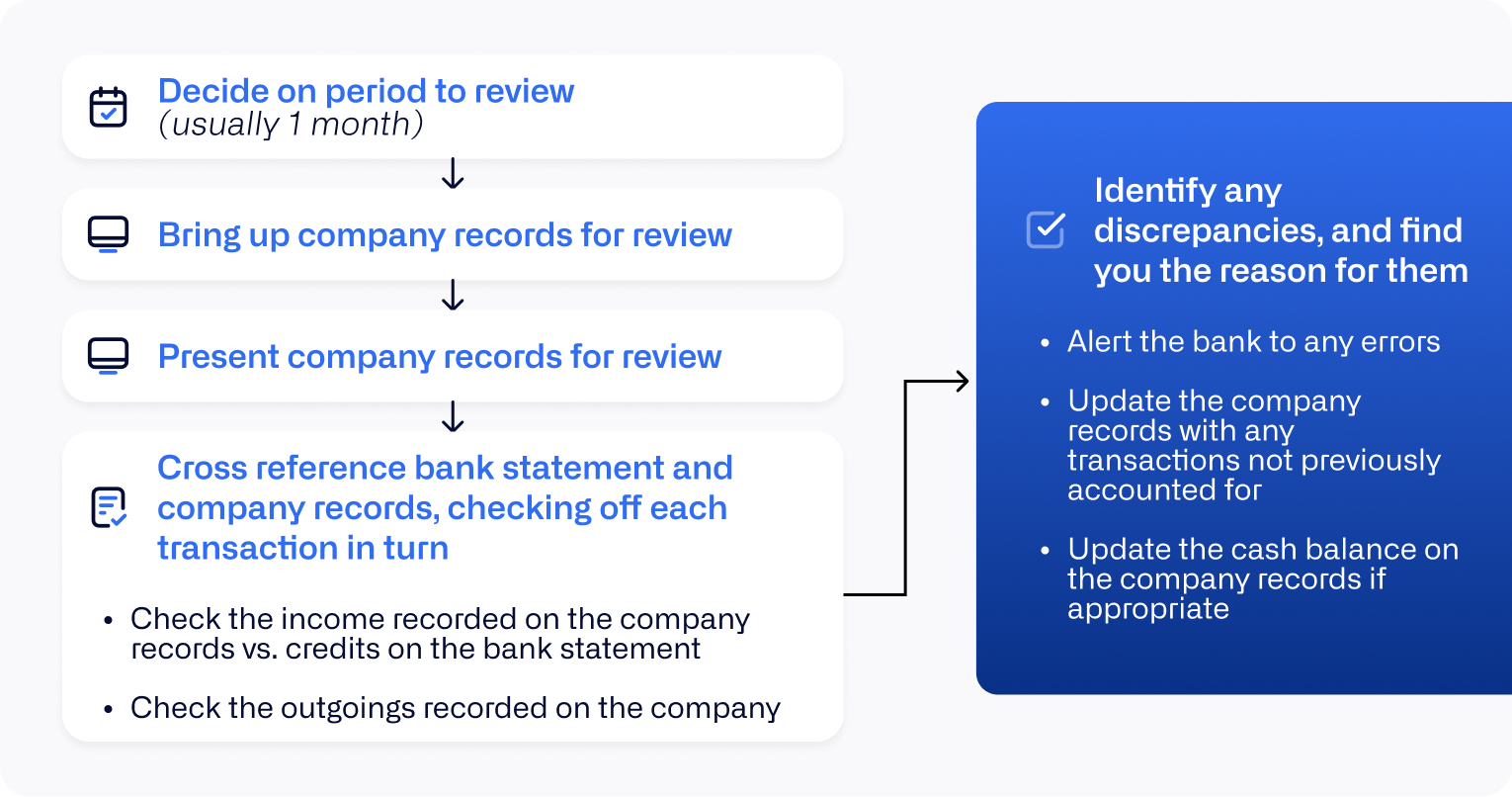

Account reconciliation simply describes the process by which the bank ‘account’ of a company is checked against the company’s own records of transactions. The best banking reconciliation software - like Agicap - automates this process to eliminate errors and save time.

What is a bank reconciliation statement?

Bank reconciliation statement formats differ, but essentially a statement shows the transactions (payments/debits) recorded in a company’s bank account and indicates whether they tally with the figures recorded in the company’s ledger/cash book. Companies - as well as banking reconciliation software - tackle this in different ways, but the aim of the statement remains to spot discrepancies, account for them and present a summary view.

Key takeaways

Accurate reconciliation is the first step a company can make towards a better idea of its cash position. This is important because improved oversight and management of cash flow reduces the risk of a liquidity crisis in the future - as well as leveraging all sorts of short-term optimisation opportunities such as cash pooling.

An appropriate bank reconciliation software suite can help companies save time and money by automating the capture of data from their banking system and reconciling it with the account statements.

The easiest way to choose the best bank reconciliation software is to look for end-to-end automation, a user-friendly interface, real-time updated dashboards, detailed reporting, easy integration, and scalability.