AI Meets Finance: Driving Real Impact, Not Just Hype

Artificial Intelligence (AI) is no longer a futuristic concept; it is a transformative force reshaping industries across the globe. In the finance sector, AI is proving to be a game-changer, offering tools and methodologies that can streamline operations, enhance decision-making, and unlock new efficiencies. However, amidst the buzz, many businesses struggle to separate the hype from the tangible benefits.

For small and medium-sized enterprises (SMEs) and mid-cap companies, the stakes are particularly high. These organizations often operate with leaner teams and tighter budgets, making it critical to invest in solutions that deliver measurable results. AI offers the potential to automate repetitive tasks, improve cash flow forecasting, and provide actionable insights—but only if implemented strategically.

This article distills insights from a recent webinar hosted by Agicap, featuring Christina Chen, CEO of First AI Group. The session, titled "AI Meets Finance: How to Drive Real Impact, Not Just Hype," explored practical ways finance teams can leverage AI to drive efficiency and innovation.

Whether you're a CFO, treasurer, or finance executive, this article will provide you with actionable strategies, real-world examples, and a clear framework for adopting AI in your organization. From identifying quick wins to avoiding common pitfalls, we’ll guide you through the steps to make AI work for your business.

The Mindset Shift: Preparing for AI in Finance

From Moonshots to 1% Everywhere

One of the key takeaways from the webinar was the importance of starting small. Christina Chen emphasized the concept of "1% everywhere," a mindset borrowed from the British cycling team that achieved Olympic success by focusing on marginal gains.

Rather than aiming for a massive, all-encompassing AI transformation, finance teams should look for incremental improvements across their workflows. For example, automating invoice reviews or using AI to generate first drafts of financial reports can save hours of manual effort. These small wins compound over time, leading to significant efficiency gains.

Chen shared a compelling example of a logistics company that used AI to review thousands of invoices each month. By automating the detection of duplicates and compliance checks, the company reduced its accounts payable cycle and flagged 21 duplicate invoices in the first batch alone. This approach demonstrates how starting with targeted use cases can deliver immediate value.

Practical Data Over Perfect Data

A common misconception is that AI requires pristine, perfectly organized data to be effective. Chen debunked this myth, sharing a story about an insurance company that had an entire floor of employees dedicated to data cleansing—a process that seemed never-ending.

Instead of waiting for perfect data, businesses should focus on "practical data." For instance, a finance team dealing with messy expense data from legacy systems can still use AI to automate categorization and flag anomalies. While the AI may only achieve 70% accuracy initially, this is still a significant improvement over manual processes. Over time, as the data improves, so does the AI's performance.

This pragmatic approach ensures that businesses can start reaping the benefits of AI without being paralyzed by the need for perfection.

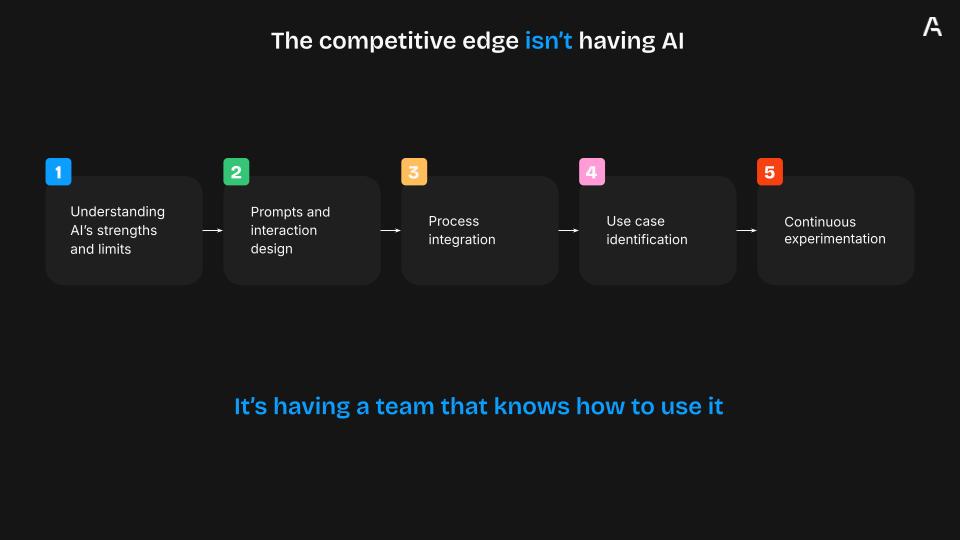

From Buying Tools to Driving Adoption

Investing in AI tools is only the first step; the real challenge lies in driving adoption across the organization. Chen highlighted the importance of change management and adoption programs, which go beyond basic training to ensure that employees actively use AI in their daily workflows.

For example, a recent project with an investment firm involved a 10-week adoption program for their finance team. By mapping out personalized workflows and creating a library of 80 tailored prompts, the team achieved a 90% usage rate for their AI tools. This level of adoption not only improved productivity but also fostered a culture of innovation within the organization.

The Role of AI Champions

Another critical element of successful adoption is identifying AI champions within the team. These are individuals who are passionate about technology and can act as advocates for AI adoption. In the investment firm example, one team member became the go-to person for AI-related queries, ensuring that the momentum continued even after the formal adoption program ended.

The Framework for Selecting AI Tools

Beyond Build vs. Buy: The Rise of Configure

Traditionally, businesses faced a binary choice when adopting new technology: build a custom solution or buy an off-the-shelf product. However, the advent of AI has introduced a third option: configure.

The "configure" approach allows businesses to take pre-built AI tools and tailor them to their specific needs. This is particularly relevant in the AI era, where tools like Microsoft Copilot or GPT-based solutions offer modular, customizable functionalities. For example, instead of building a bespoke AI solution from scratch—a process that requires significant time, resources, and technical expertise—companies can start with a pre-built AI agent and configure it to align with their workflows, data, and objectives.

This approach is not only cost-effective but also accelerates time-to-value. A mid-sized finance team, for instance, could use a pre-built AI tool to automate cash flow forecasting. By configuring the tool to account for their unique payment cycles, customer behaviors, and seasonal trends, they can achieve a level of precision that would otherwise require a custom-built solution.

Moreover, the configure model bridges the gap between scalability and personalization. While off-the-shelf solutions are designed for broad applicability, configuring them allows businesses to add the context and specificity that drive real impact. This hybrid approach is particularly valuable for SMEs and mid-cap companies, which often lack the resources for full-scale custom development but still need solutions tailored to their unique challenges.

High-Impact Use Cases

AI is particularly effective for repetitive, data-intensive tasks. Some of the high-impact use cases highlighted in the webinar include:

- •

Cash Flow Forecasting: Using AI to analyze historical data and predict future cash flow trends.

- •

Invoice Categorization: Automating the classification of transactions to save time and reduce errors.

- •

Budget Variance Analysis: Generating first drafts of budget reports and identifying key variances.

For example, Agicap’s AI assistant can analyze a company’s financial data to answer questions like, “Will I have enough short-term cash to make a payment of £150,000 in three days?” This level of insight enables finance teams to make informed decisions quickly.

Low-Impact Use Cases

While AI excels in many areas, there are certain tasks where its impact is limited. These "low-impact" use cases typically involve one-off tasks, high levels of judgment, or strategic decision-making. For example, creating a long-term financial strategy or negotiating complex contracts often requires nuanced understanding, emotional intelligence, and the ability to weigh multiple variables—areas where human expertise still outperforms AI.

Additionally, tasks that are infrequent or highly specialized may not justify the investment in AI. For instance, conducting a once-a-year audit or preparing for a rare regulatory review might not benefit significantly from AI automation. In such cases, the time and effort required to train the AI or configure it for the task may outweigh the potential benefits.

However, this doesn’t mean AI has no role in these areas. It can still serve as a valuable assistant, providing data summaries, generating initial drafts, or offering scenario analyses. The key is to use AI as a complement to human expertise, rather than a replacement.

Avoiding Common Pitfalls

Pilot Purgatory

One of the most common mistakes is getting stuck in "pilot purgatory," where AI initiatives remain in the testing phase and never scale to full implementation. This often happens due to a lack of clear objectives, insufficient planning, or uncertainty about next steps.

To avoid this, businesses should start by defining specific, measurable goals for the pilot. For example, instead of vaguely aiming to "improve efficiency," set a target like "reduce invoice processing time by 30%." Clear objectives provide a benchmark for success and make it easier to decide whether to scale the initiative.

Equally important is planning for what comes next. Before launching a pilot, finance teams should outline a roadmap for scaling successful initiatives. This includes identifying the resources needed, setting timelines, and ensuring alignment with broader business objectives. Without this forward planning, even the most promising pilots can lose momentum.

Finally, leadership buy-in is crucial. CFOs and other decision-makers must champion the initiative, allocate the necessary resources, and communicate its importance to the team. This top-down support can make the difference between a stalled pilot and a successful implementation.

Waiting for Perfect Data

As discussed earlier, waiting for perfect data can delay progress indefinitely. Instead, focus on practical data and use AI to improve data quality over time. For example, an AI tool can be used to identify inconsistencies or gaps in existing datasets, providing a roadmap for data cleansing efforts.

Additionally, businesses can adopt a phased approach, starting with smaller, well-defined datasets before scaling to more complex ones. This allows teams to build confidence in the AI’s capabilities while gradually improving data quality.

Conclusion

AI has the potential to revolutionize finance, but its success depends on strategic implementation and adoption. By focusing on incremental improvements, leveraging practical data, and fostering adoption and continuous improvement, SMEs and mid-cap companies can unlock the full potential of AI.

Ready to take the next step? Learn more about Agicap’s AI-powered assistant.