What role does AI play in finance? Examples and opportunities

What is AI in finance?

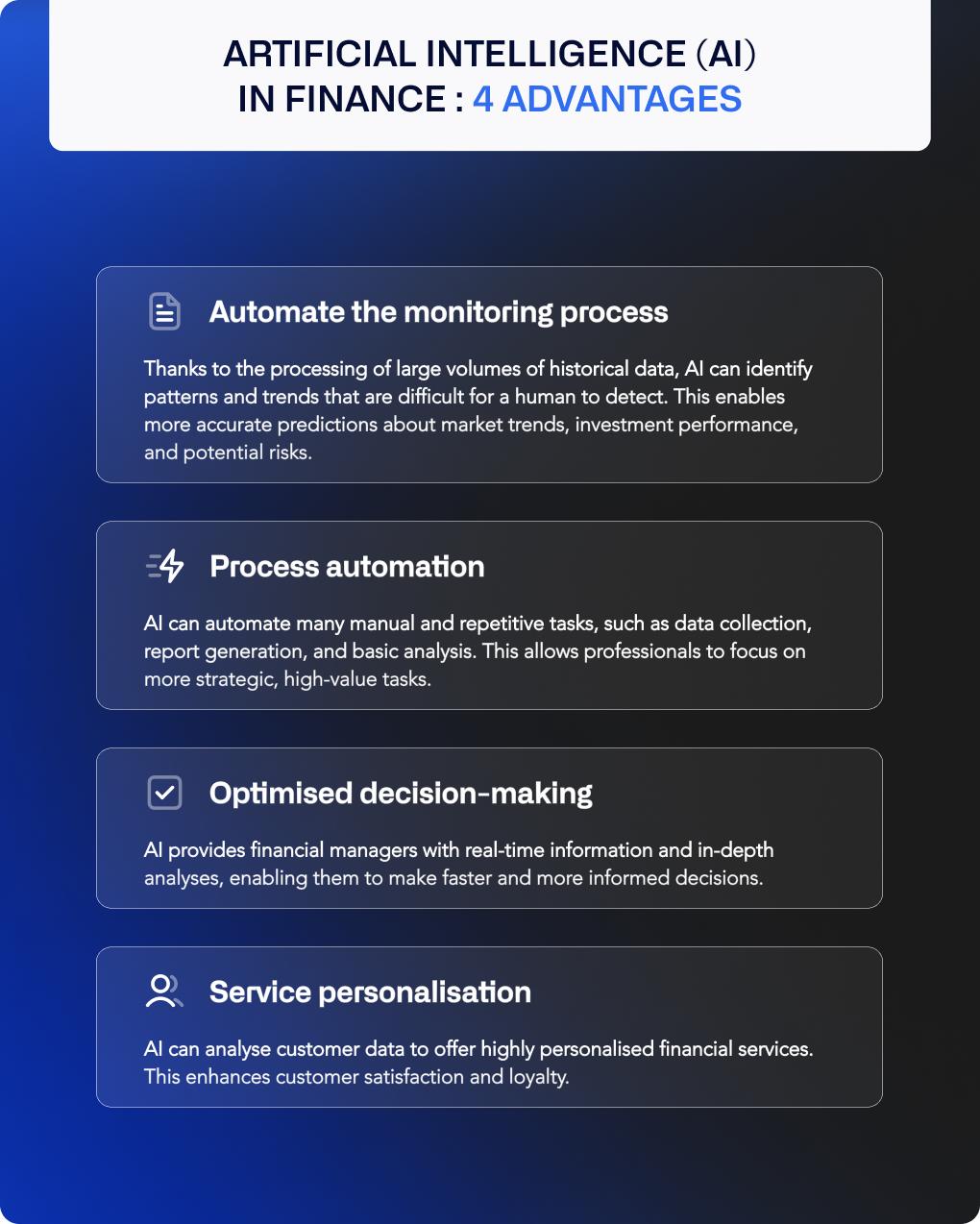

The use of Artificial Intelligence (AI) in finance is widespread - from high profile areas like risk management, stock trading and cybersecurity, to more mundane fields like accounting and retail banking.

AI is able to analyse Big Data - i.e. vast pools of unstructured data - far faster and more efficiently than other forms of computing can. Artificial Intelligence can also learn from its mistakes. So until quantum computing takes off, AI is set to be the dominant driver of improvements in finance analysis, operations and security.

How is AI used in finance?

Financial crisis prediction

The World Economic Forum in 2024 confirmed that, "AI may soon predict financial crises before they take root." Research by the University of Lichtenstein suggests that "AI can significantly enhance the detection and prediction of financial downturns".

The research used machine learning to inspect historical U.S. regional banking crises and applied clustering, ridge regression, and sequential feature selection to account for the crises in retrospect. This technology has yet to find a commercial application, but may revolutionize the cycle of bust and boom to which economies are subjected.

Risk management

This is a key area of AI application for the simple reason that managing risks is what keeps companies in business. They are therefore prepared to invest heavily in enhancing their risk management capacity. Thus, fraud detection, market risk, stress testing, and regulatory compliance are four of many areas of risk management where AI is making an impact.

Fraud detection

Fraud detection typically involves spotting cases where criminals use false credentials to make transactions to which they are not entitled.

- Datavisor sharpens up the defenses of financial institutions against fraud with its SaaS platform. Thanks to its patented machine learning algorithms, Datavisor offers a 20x faster and more accurate rate of fraud detection with its AI Co-Pilot.

- Feedzai offers a RiskOps Platform for banks and financial institutions, using AI to analyze transaction patterns and spot fraudulent anomalies.

- FICO Platform deploys AI to detect real-time fraud, especially in credit card transactions and payments.

Market risk

Assessing market risk means deciding which way the market is going - whether up or down - and how this affects stock portfolios.

Key players using AI in market risk include:

- Qontigo, whose Axioma analytics suite provides investment management solutions worldwide.

- Numerai, an AI-run hedge fund that relies on a network of anonymous data scientists.

- BlackRock, utilizing AI in their Aladdin investment management platform for market risk analysis.

Stress testing

Companies periodically undergo stress testing, simulating responses to economic crises such as market crashes or supply chain collapses. AI is enhancing efficiency in this field.

Notable companies include:

- McKinsey’s QuantumBlack Labs, which deploy AI technology for risk resilience assessments.

- Ortec Finance, using AI to analyze economic risks and generate predictive scenarios.

- Quantitative Risk Management, specializing in AI-driven stress testing for financial institutions.

Regulatory compliance

Financial institutions must comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. AI helps automate compliance and enhance efficiency.

Examples:

- ComplyAdvantage specializes in AI-driven fraud and AML risk detection, reducing false positives by 70%.

- NICE Actimize monitors 5 billion financial transactions daily for AML violations.

Blockchain

Blockchain and AI are complementary technologies. Blockchain offers transparency and speed, while AI enhances automation and analytics.

Quantum Blockchain Technologies (QBT)

A London-based firm that developed AI Oracle, an AI-powered model improving Bitcoin mining efficiency by 30%.

Cortex Labs

This company enables AI models to be used on the blockchain, allowing smart contracts and decentralized apps (Dapps) to integrate AI capabilities.

Quantitative trading

Quantitative traders, or "quants", use AI to analyze Big Data and develop trading strategies.

Two Sigma Investments

A $52 billion hedge fund using machine learning, deep learning, and NLP to develop predictive trading algorithms.

Jump Trading

A leader in High-Frequency Trading (HFT), Jump Trading leverages AI for real-time decision-making, risk management, and price optimization.

Cybersecurity

AI plays a crucial role in cybersecurity, given its ability to analyze massive datasets and detect threats in real-time.

Darktrace

A UK-based firm using AI-driven Enterprise Immune Systems to protect 10,000+ businesses from cyber threats.

Vectra AI

Uses AI Attack Signal Intelligence to enhance Extended Detection and Response (XDR), reducing analyst workload by 38x.

Other AI-driven cybersecurity firms include:

- Symantec (Broadcom) – Using AI to combat ransomware.

- Sophos Intercept X – Leveraging deep learning for malware detection.

- IBM QRadar & Watson – Automating security incident response.

Credit management

AI is improving credit management by enhancing decision-making, reducing risks, and automating processes.

Zest AI

Ranked in the Deloitte Technology Fast 500, Zest AI automates 80% of lending decisions and reduces risk by 20%.

LenddoEFL

A Singapore-based firm using machine learning and psychometric data to generate personalized credit profiles.

Other AI-driven credit management companies include:

- TrueAccord – Automating overdue payment reminders.

- Kabbage & Avant – AI-powered loan approval processes.

- Moody’s Analytics & Kensho (S&P Global) – AI-driven risk assessment.

Accounting & Accounts Payable

AI is revolutionizing Accounts Payable (AP) by automating invoice processing, improving accuracy, and detecting fraud.

- Agicap, Airbase, Stampli & Lightyear – Using AI for faster, more accurate invoice processing.

- Highradius – Employing AI for predictive validation workflows.

- Celonis, Esker & Tesorio – AI-driven shortfall risk assessment.

- Coupa – AI-powered fraud detection.

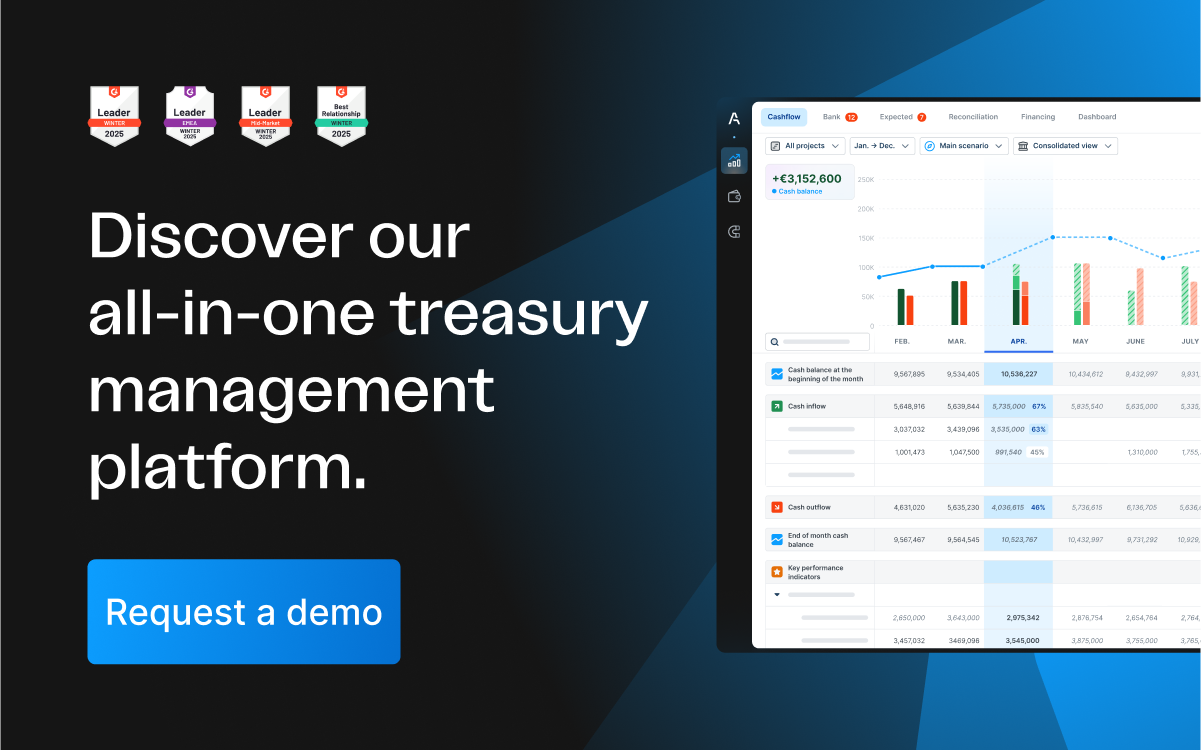

Agicap AI for finance analysis and assistance

Agicap, a leader in cash management software, has developed the Agicap AI assistant to enhance user experience.

Features of the Agicap AI assistant:

- Deep insights: "What is the impact of a 20% reduction in my DSO on my cashflow?"

- Smarter decisions: "Will I have enough short-term cash if I make a €150,000 payment in three days?"

- Faster data access: "Generate a graph of my 10 biggest customers last quarter."

The Agicap AI assistant is available as part of the Agicap cash management platform.