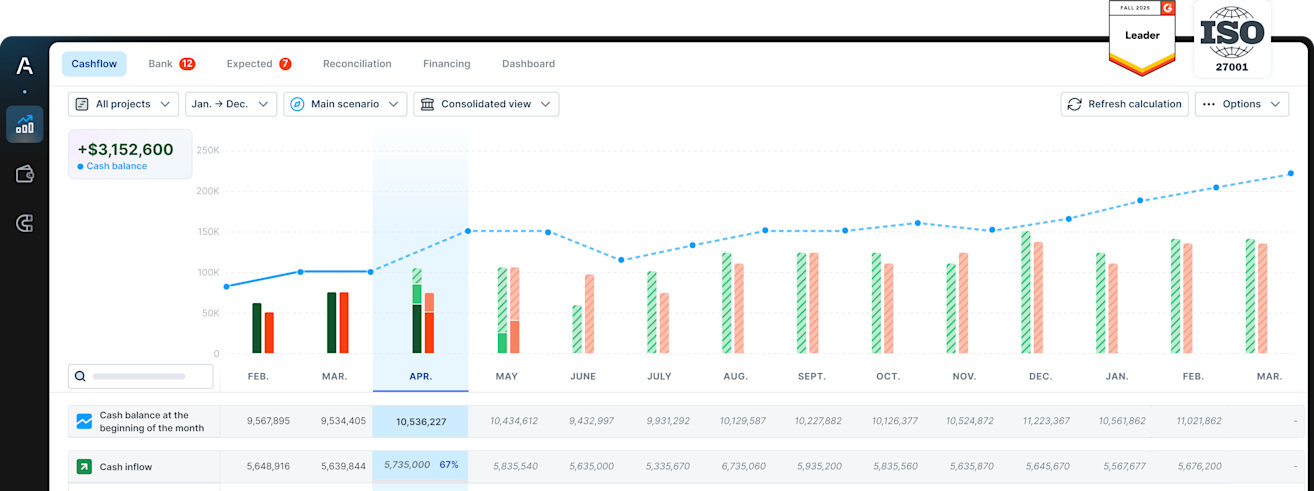

A new way to manage your cash flow

Monitor your cash position, forecast, payments execution, accounts payable and accounts receivable.

One cash flow management platform to manage your cash with ease

Cash flow management

Get real-time visibility on your cash and anticipate future trends.

Bank & Accounting Connectivity

Connect your banks, accounting softwares & ERPs. Benefit from a single source of truth. Redistribute data to your business tools.

Accounts Payable

Automate your purchasing processes. Control all your expenses. Improve the reliability of your cash flow forecasts.

Accounts Receivable

Improve your collection. Reduce your DSO. Refine your forecast with each customer's actual DSO.

Payments made simple

Make secure international payments in any currency. Maintain full visibility and control over your transactions.

Cash flow management service that seamlessly integrates with your eco-system in place

Instant cash visibility:

Connect your banks, ERPs, and data in one unified cash flow management platform to monitor actual positions in real time.

Reliable short-term forecasts:

Project up to 13 weeks ahead based on actual data, not assumptions.

Centralized & automated processes:

Streamline reconciliation, automate forecasting, and reduce manual errors.

Daily control & agility:

Rebalance accounts and make informed decisions on a day-to-day basis.

Consolidated reporting:

Access accurate reports and simplified compliance without the hassle.

Complement to FP&A tools:

While FP&A focuses on long-term planning, Agicap is built for daily cash management.

Achieve your goals with integrated cash flow management tools

Give your team new opportunities to improve your cash position.

Get everyone on the same page with our shared, intuitive workspace.

For finance teams

Collaborate on a single cash flow management platform to save time in your operations. Automate and centralize reliable data for cash management and reporting.

For decision-makers

Stay on top of your cash flow management. Make better decisions based on reliable, real-time data. Increase visibility and impact on accounts payable and accounts receivable.

For treasurers

Gain visibility over cash flow operations, improve your financial income by investing your surpluses and reduce the risk involved in planning your cash flow.

Strengthen your financial knowledge with our resources

Frequently Asked Questions

What is a cash flow management software?

Cash flow management software centralizes and monitors all cash inflows and outflows, providing real-time visibility into a company’s liquidity across multiple time horizons—from daily operations to short-term (weekly), mid-term (quarterly) or even long-term (annually & multi-year) planning. This type of tool supplies finance departments and decision-makers with comprehensive and up-to-date financial data to secure both immediate and future liquidity.

Precise cash flow management is now more critical than ever. With interest rates significantly higher than during the 2010–2021 period, cash is no longer a low-cost resource. Inefficient cash management now incurs substantial direct costs (ex. overdraft fees, interests paid on credit lines) eroding net income as well as opportunity costs, directly impacting a company’s financial health and growth potential.

With over 8,000 clients in 12 countries and a 98% satisfaction rating, Agicap is the leading cash flow management software for SMBs and mid-market companies. Agicap stands out thanks to its comprehensive approach to cash management & cash flow forecasting.

Powerful cash flow management provides a reliable platform for clients to make better informed strategic decisions regarding their growth and the means to finance it (debt, self-financing…) without jeopardizing liquidity.

How does a cash management software work?

Cash management softwares like Agicap consolidate fragmented data—from bank statements, ERP/accounting systems, spreadsheets, and other financial tools—into a single, unified view. This integration delivers real-time visibility into a company’s liquidity and working capital requirements, enabling better informed and more agile financial decision-making.

Agicap’s integrated cash management platform equips CFOs with the tools needed to create accurate and reliable cash forecasts. In the short term, finance departments can mitigate the risk of cash shortage and even increase financial income through optimized interest income.

Cash management software is only as good as the level of connectivity it is based on. The best cash management softwares offer secure, real-time integration with a company’s existing ERP/accounting softwares, bank accounts and other finance softwares.

How can cash flow management softwares help during periods of economic uncertainty?

Cash flow management softwares like Agicap enable finance teams to track all expected future cash inflows and outflows. In a context of economic uncertainty, this tracking is all the more valuable as :

Finance teams can drill down on overdue receivables to improve collection

Finance teams can avoid unnecessary financial costs by balancing bank accounts or better scheduling payments to avoid overdrafts. Additionally, leveraging cash flow management software allows them to minimize reliance on invoice financing or credit lines, further optimizing financial expenses.

Automations remove manual errors and ensure the data the finance teams run their models with is reliable and up to date.

Automations also significantly reduce the time finance teams spend on data updates and reconciliations, allowing them to focus on higher-value initiatives—such as assessing and modeling the current and future risks arising from economic uncertainty.

What types of integrations does Agicap support?

Search here to see if Agicap already integrates with software you are using. We can connect with any tool at your request.

Agicap cash flow management software currently integrates with over 300 tools across 6 key categories:

Banking. Agicap supports connections with US banks through multiple protocols (SWIFT, Host-to-Host, partner connectors)

ERP and Accounting. Agicap is able to retrieve data from and push data into your ERP and accounting tools’ systems for accurate real-time monitoring. Supported tools include QuickBooks, Xero, and Oracle NetSuite, which are widely used in the US. Our OpenAPI is available for custom integrations with ERP and accounting tools not natively supported.

Spend and Invoice Management. Centralize data relating to your expenses by using Agicap’s dedicated module, or connect Agicap to your existing tool.

Payment. Use Agicap to securely send your payment instructions to your different banks. For U.S.-based businesses, Agicap supports ACH (Automated Clearing House) payments, enabling automated domestic transactions.

File Storage and Spreadsheet Integrations. The File Manager feature allows saving, viewing, and managing daily bank statements. Spreadsheet imports are also supported to fuel several modules (forecasts, KPIs, accounts receivable)

Customization and Automation. Dataflows can be created for automating data transfers between any server and Agicap, enhancing efficiency for US businesses.

How secure is my financial data with Agicap?

is the foundation of Agicap's cash management software. Our software is built upon globally recognized standards to ensure the security and privacy of your data:

Data Privacy Compliance. Agicap strictly complies with all applicable data protection regulations, including international standards, to ensure the security and confidentiality of your personal and financial information.

ISO/IEC 27701. Your data is encrypted and stored on Google Cloud Platform servers located in Belgian data centers, which are certified under the ISO/IEC 27701 standard—the leading global benchmark for Privacy Information Management Systems.

TLS Encryption. We use Transport Layer Security (TLS) to encrypt your data while it is in transit, ensuring secure communication and protection against unauthorized access.

By backing up your data on secure servers, we guarantee a high degree of availability. In the event of a server incident, your data will not be affected; a replacement server will automatically take over.

Pro-active data security is our priority: we conduct annual security audits with independent experts to identify and address potential vulnerabilities, continuously strengthening our defenses.

How can I get started with Agicap’s cash flow management software?

For a free custom demo, simply fill in your business email. A dedicated Agicap expert will contact you within the hour to answer all your questions, evaluate your company’s specific needs, and present a customized overview of our solution.

You can test Agicap yourself with a 24-hour free trial—no download required, as it’s a fully cloud-based solution. To get started, just provide a few business details.